The Easy Saver

The Easy Saver

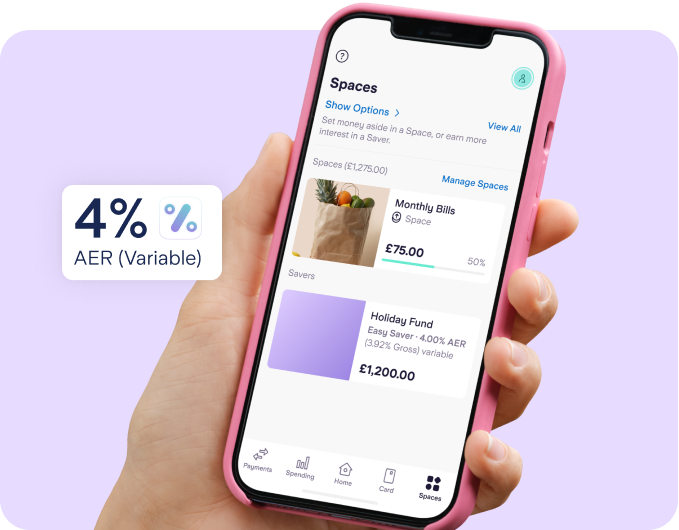

Earn 4% AER (3.92% gross) variable* interest on your money. Add and withdraw as often as you like, with no minimum deposit and no penalties.

How to apply*18+, UK residents. Interest paid monthly. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

Save when you can. Spend when you want.

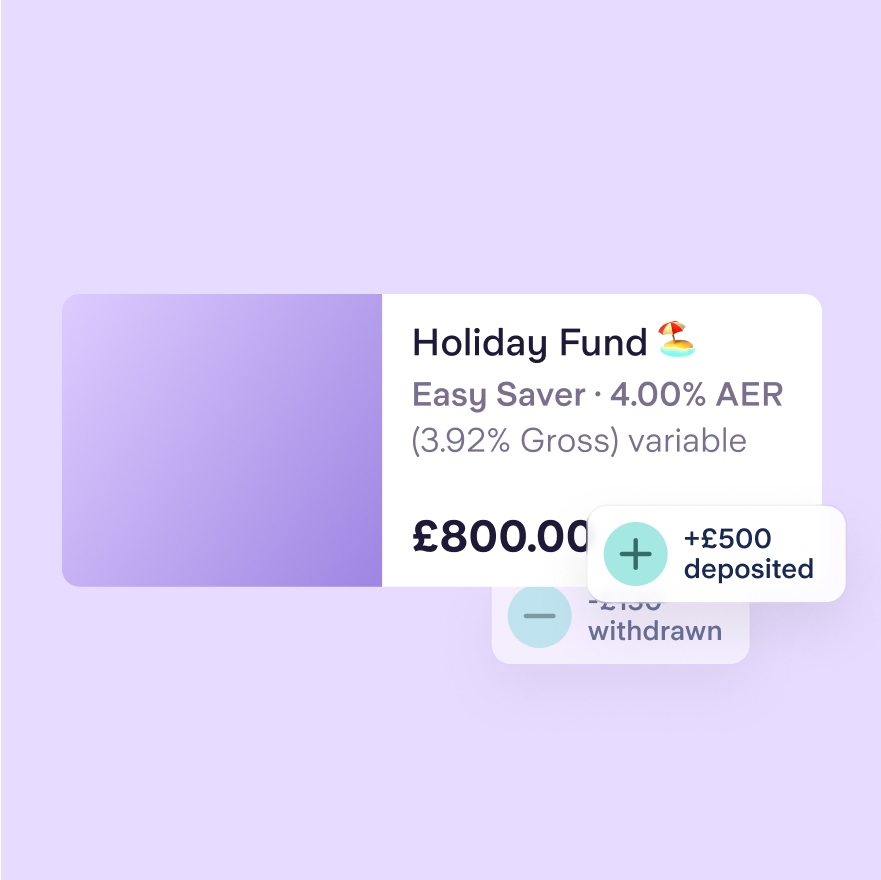

Add money to save or withdraw money into your personal current account to spend – as many times as you like. No notice period and no penalties either. Easy, right?

Why pick the Easy Saver?

4% AER, 3.92% gross variable interest, paid monthly

Add or withdraw to your personal current account at any time, with no penalties

No minimum deposit to open

Earn interest on balances up to £1 million

See all your accounts with us in your Starling app

Your money is covered by FSCS up to £85,000 across all your Starling accounts

Compare accounts

See how our personal savings accounts compare.

Personal current account required to open either an Easy Saver or Fixed Saver.

Subject to eligibility.

| Features | Easy Saver | Fixed Saver |

|---|---|---|

| Interest rate | 4.00% AER 3.92% gross variable | 4.05% AER/gross fixed |

| Interest paid | Monthly | End of term |

| Access to funds | Unlimited access | No access for 12 months |

| Account term length | N/A | 12 months |

| Minimum and maximum deposit | £0 - £1m | £2,000 – £1m |

| Number of accounts you can open | 1 | Up to 50 |

How to open an Easy Saver

New to Starling? You’ll need our award-winning current account before you can apply for an Easy Saver. Then, just follow the steps below to get an Easy Saver.

Already a customer? If you already have a Starling personal current account, check your app to see if you can apply.

Subject to eligibility, T&Cs apply.

Read the key information about this account in the summary box below.

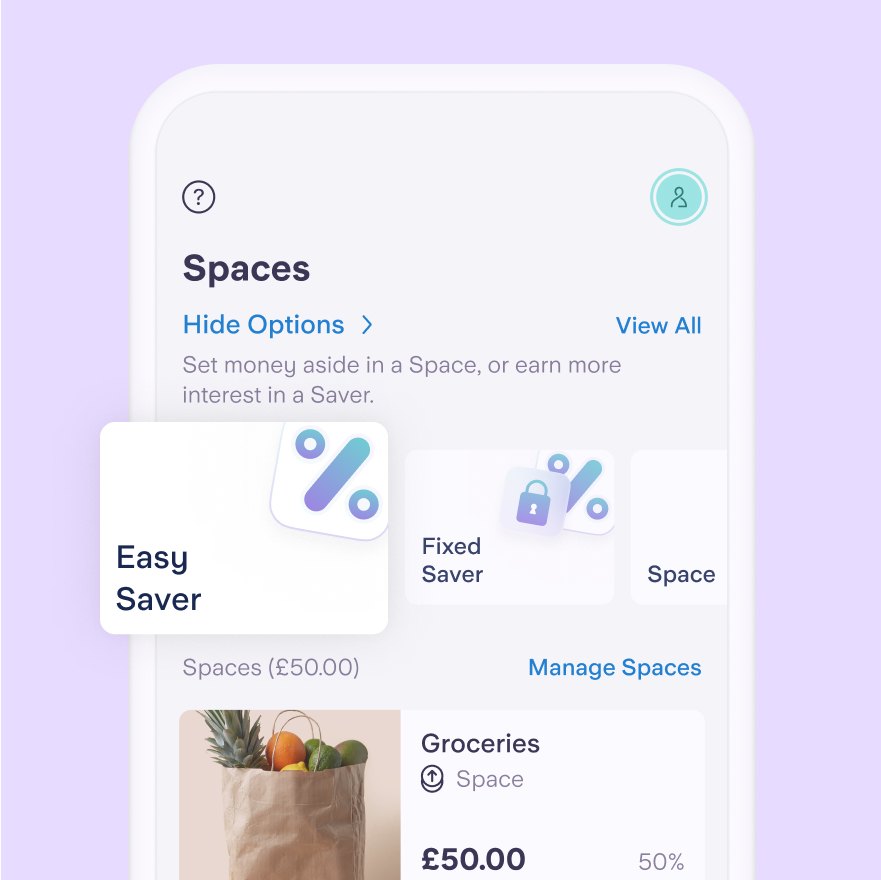

Step 1

Head to Spaces, then choose Easy Saver from the list of Space types. You may need to tap Show Options at the top to see them.

Step 2

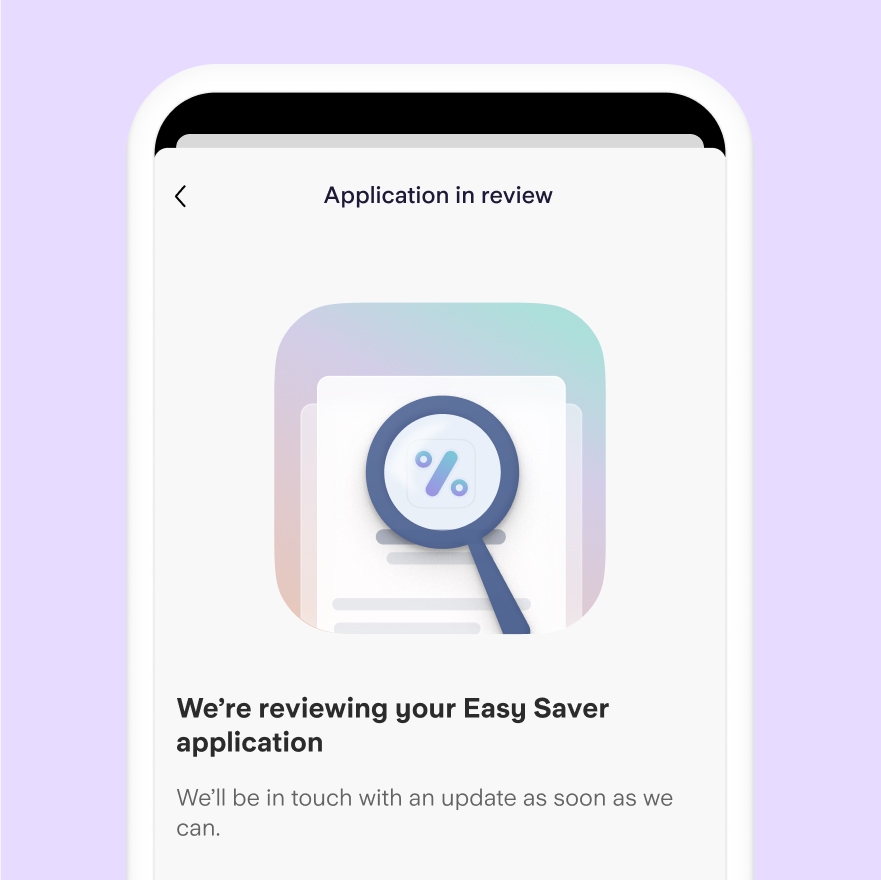

Follow the steps and fill in a short application. There’s no minimum deposit so you can open your account with whatever you’re comfortable with.

Step 3

Once approved, you’ll be able to make unlimited withdrawals and deposits, with no penalties and no need to give any notice.

Summary box

What is the interest rate?

4.00% AER / 3.92% gross (variable)

The Annual Equivalent Rate (AER) shows what the interest rate would be if interest was paid and compounded once a year. It’s used to help you compare between savings accounts.

The ‘gross’ rate is the actual rate we’ll pay. Paying gross interest means we don’t deduct any tax you might owe.

We calculate and compound interest daily based on your Easy Saver’s balance at the end of each day (plus any interest earned but not yet paid into your account) - ‘compound’ means we pay interest on the interest you’ve already earned. We pay interest into your Easy Saver on the first day of every month.

Can Starling change the interest rate?

Yes, the interest rate is variable which means it can go up or down.

The account terms and conditions explain why we might change the interest rate and how we’ll let you know that it is changing.

If the rate is decreasing, we’ll give you at least 14 days’ notice before this happens. We’ll let you know by email if you’ve verified your email address. Otherwise we’ll send you a message in the app.

You can close your Easy Saver at any time.

What would the estimated balance be after one year based on an initial £1,000 deposit?

4.00% AER / 3.92% gross (variable)

Balance after one year: £1,040

This estimation assumes that:

there are 365 days in the year

you don’t make any withdrawals or deposits in that time

the rate doesn’t change in that time

How do I open and manage my account?

To open an Easy Saver, you must:

have an open Starling personal account

be aged 18 or over

be a UK resident

As we are a regulated bank, you also need to go through some additional eligibility and fraud checks. We’ll use the personal information we hold for you to complete these checks. If you need to update any of these details, make sure to do this before submitting your application.

You can open and manage your Easy Saver in the app – you can’t access it through online banking.

There isn’t a minimum deposit amount to open the Easy Saver. You can only make deposits into it from your Starling personal account.

You can earn interest on a maximum of £1,000,000 in your Easy Saver. Once your Easy Saver reaches this amount, we’ll continue to pay interest on the £1,000,000 but you won’t be able to pay in any more money.

You can only have one Easy Saver open.

Can I withdraw money?

You can withdraw money from your Easy Saver whenever you like, but it can only be moved into your Starling personal account. You can’t directly move money from your Easy Saver into other bank accounts.

Any withdrawals you make will go into your Starling personal account straightaway. You can make as many withdrawals as you like, and you can withdraw as much as you like (up to your available account balance). We won’t charge you for withdrawals.

You can’t withdraw money by cash or cheque.

Additional information

You can close your Easy Saver whenever you like in the app. If you close it, any money will be paid into your Starling personal account. If you want to reopen an Easy Saver in future, you’ll need to reapply and go through eligibility and fraud checks again.

If you want to close your Starling personal account, you’ll need to close your Easy Saver first.

We pay ‘gross’ interest, which means we don’t deduct any tax you might owe. You may benefit from a Personal Savings Allowance that varies depending on your other sources of income. You can find out more about this at www.gov.uk/apply-tax-free-interest-on-savings

You may need to declare the interest you earn on this product in your self-assessment tax return – you can access an interest statement in the app if you need one.

The tax you have to pay will depend on your circumstances, and the rules could change in the future.