Protecting you from fraud and scams

Protecting you from fraud and scams

Does a payment request feel a little off?

Whenever you’re asked for money, stop and take a moment to think. Could it be a scam?

If you suspect it could be, call 159: the hotline designed to fight fraud.

Always remember, we’d never:

ask you to make or approve payments to “keep your account safe”

ask you to assist with an investigation

call or text you about fraud, without messaging you in the app first

ask for your PINs or passwords

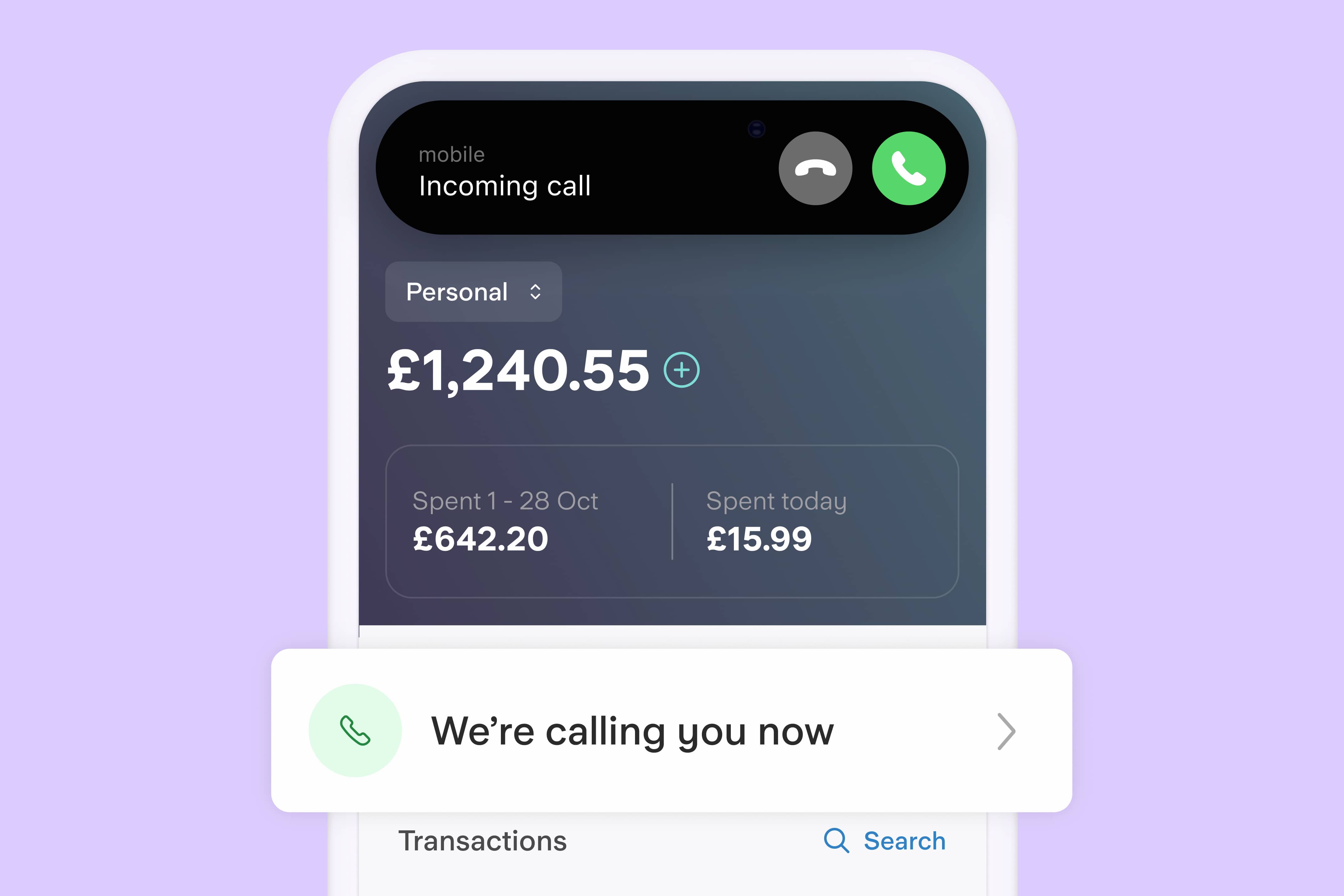

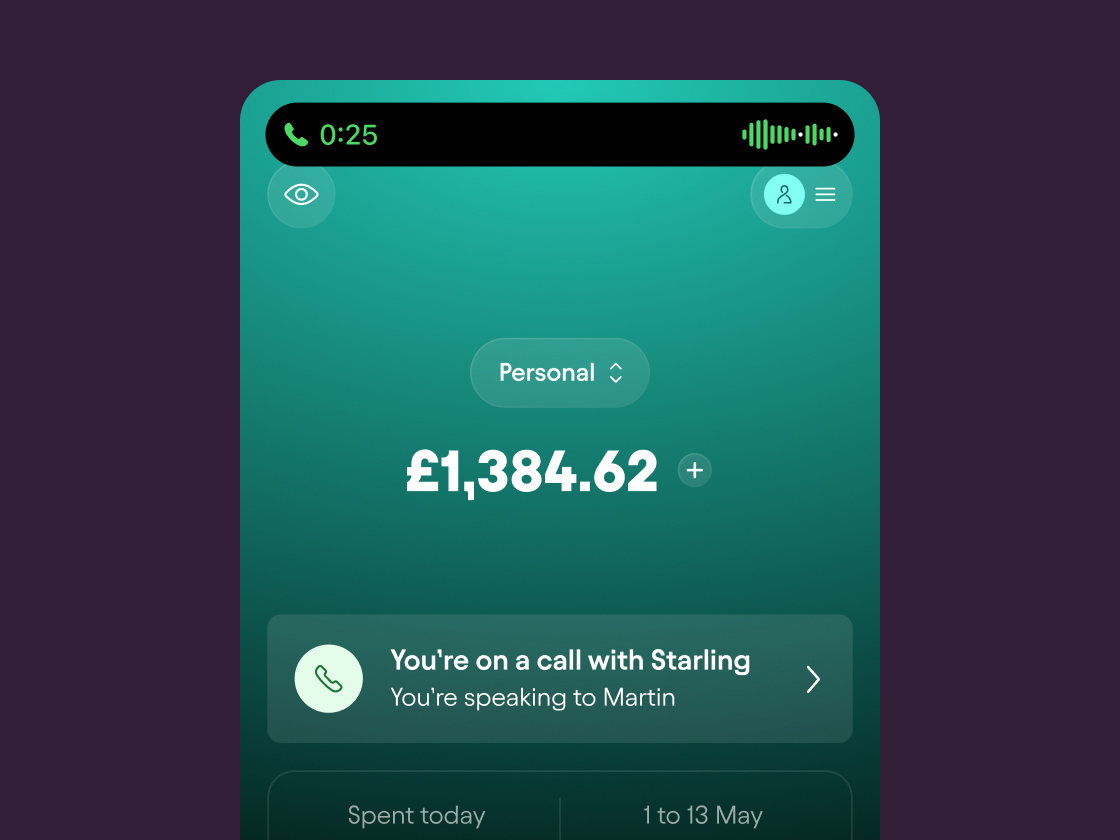

If someone calls you saying they’re from Starling Bank, you can verify if they’re telling the truth by opening your app and checking the ‘Call status’ banner.

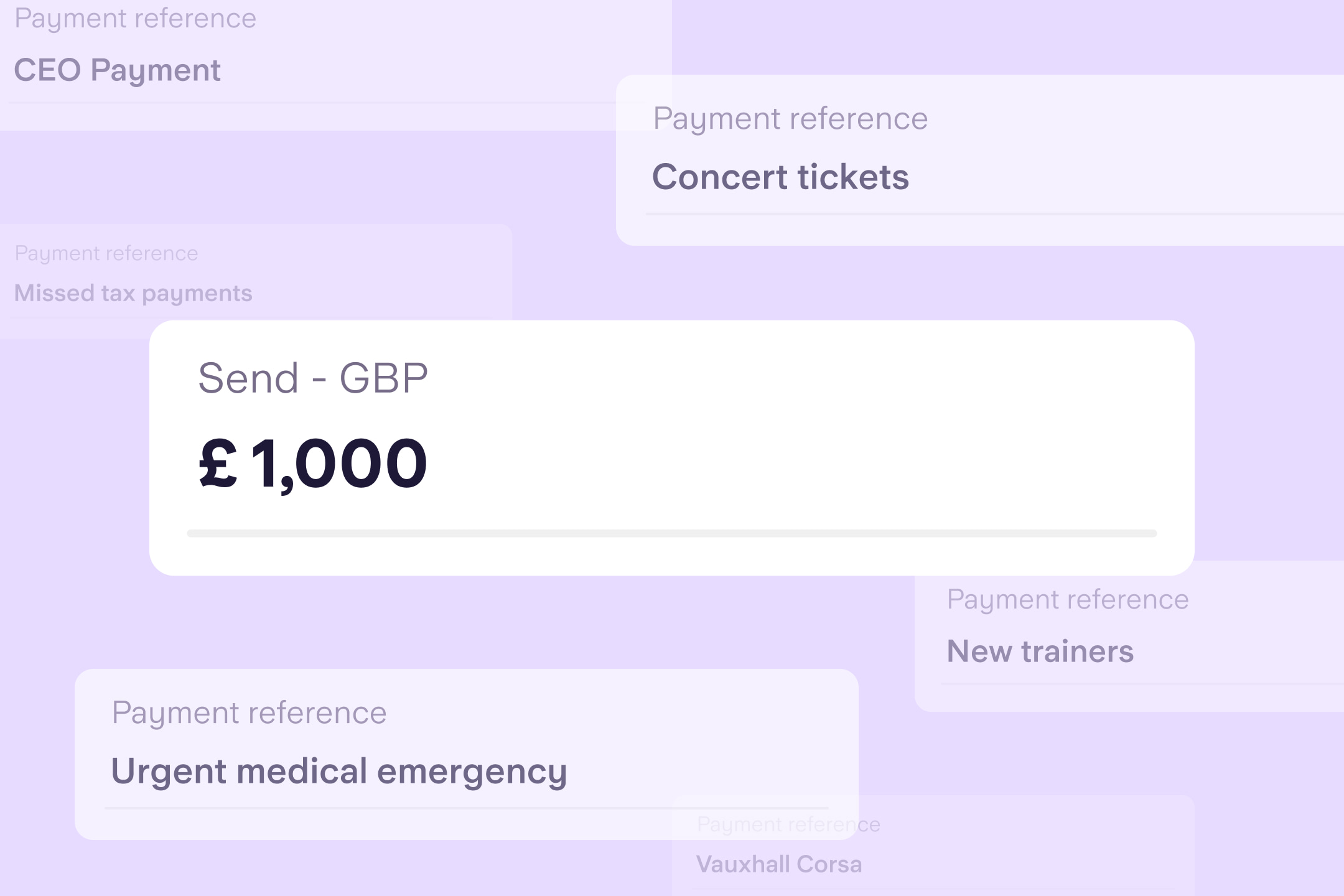

Scams to watch out for

Things to keep in mind

Sending money to a new payee? Always take the time to consider if it could be part of a scam.

Something’s urgent or time-sensitive? Don’t let anyone pressure you into making a quick decision.

Is the person you’re speaking to genuinely who they say they are? Contact them via a different method just to be sure.

Does a call, message or email feel a little off? Speak to a family member or friend, they may be able to help you tell if it’s a scam.

Phone numbers can be spoofed to disguise where a call or text is coming from. Don’t rely on this to check if someone is who they claim to be.

If something sounds too good to be true, it probably is.

Listen to or read any warnings your bank gives you.

Be wary if someone tells you to lie to your bank.

We’d never ask you to share your PIN or password, or to authorise a payment from your account to a new “safe account”. Neither would any other bank.

If someone calls you saying they’re from Starling Bank, you can verify if they’re telling the truth by opening your app and checking the ‘Call status’ banner. If it says ‘We aren’t calling you’, hang up and call 159.

Reporting fraud

If you think you may have been a victim of fraud, get in touch with our customer support team as soon as you can.

Whether you’re in the UK or abroad, calling us on 0207 930 4450 is the fastest way for us to get all the information we need. Or you can speak to us via our in-app chat, if you prefer. Either way, we’re here 24/7.

You can also report fraud or cybercrime to Action Fraud, via their online reporting tool. If you live in Scotland, please contact Police Scotland on 101.

How we protect your money

We’ve built industry-leading security features. Then added tools to help you manage your money, your way. Whether you’re opening an account (e.g. video ID), logging into the app (e.g. biometric ID), or making a payment (e.g. real-time notifications), our app is secure.

Beyond your day-to-day spending, we’ve also built special features to keep your money safe when you’re paying someone new (e.g. Confirmation of Payee) or shopping online (e.g. 3D Secure).