Mobile banking security

Mobile banking security

How we protect your money.

We’ve built some of the world’s best banking security. Then added tools that help you do security your way, from logging in to making payments online.

How the Starling app is secured

Passport or UK driving licence

To apply for our current account, we’ll ask you to share a government-issued identity document so we can verify the details you’ve given us and check they’re genuine, which helps to prevent identity fraud.

Video identification

When we verify your details in the account application process, we’ll ask you to film a short video of yourself so we can make sure that it’s really you.

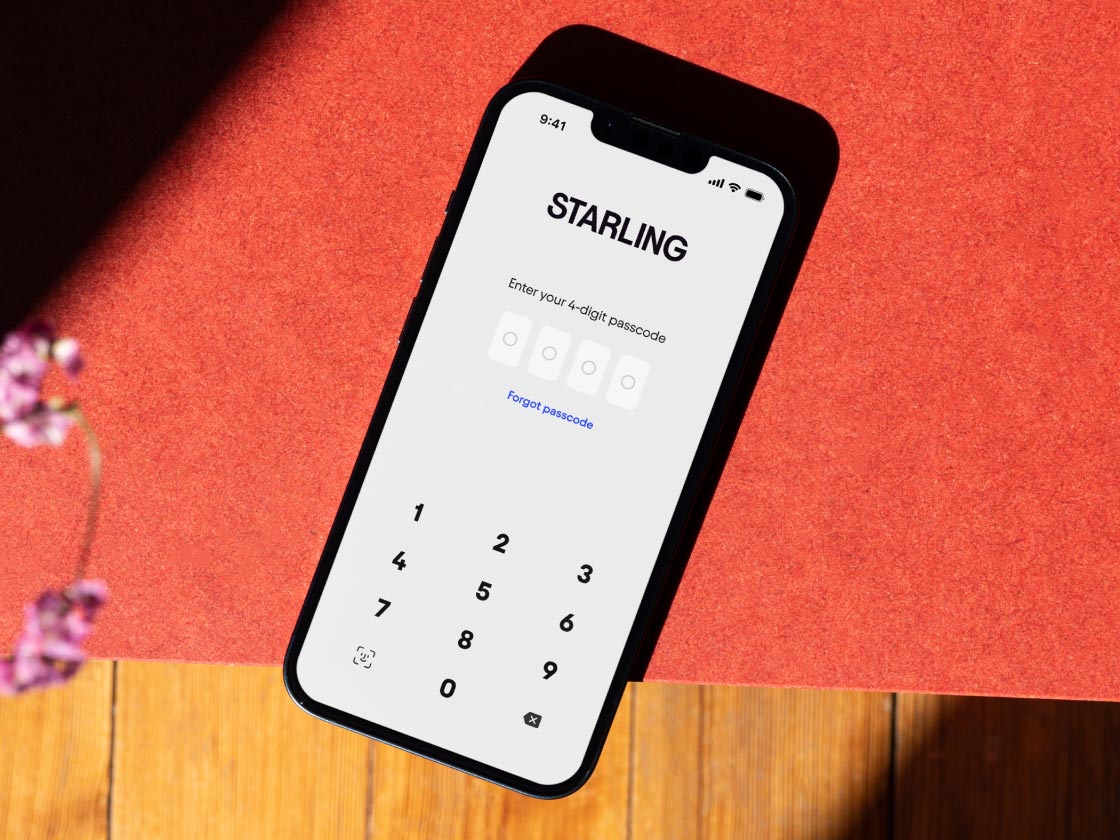

Mandatory passcode

We set a mandatory per device PIN code to keep your app secure, as well as utilising biometrics where supported.

Password

To set up payees and authorise payments, we’ll ask you to setup a personal password. You’ll also be asked for your password to edit any of your personal information in the app.

Features to help keep you safe

Real-time notifications. Stay in the loop about what’s coming in and out of your account.

Card controls. Choose whether you want to allow or disable contactless and chip & pin payments, ATM withdrawals, online payments and your mobile wallet – or freeze or cancel your card instantly if you think it might be lost or stolen.

Biometric identification. Fingerprint or facial recognition is one of the most secure ways to log in to your app. It’s worth setting up if your phone supports it.

Scam Intelligence. Looking to buy something from an online marketplace? Don’t take a chance, take a screenshot. Then upload your screenshot to our app and our AI-powered Scam Intelligence tool will analyse it and let you know of any potential risks it’s spotted.

3D Secure. It’s an extra layer of security when you use your card online. When this is required, we’ll send you a push notification for you to approve the transaction directly in-app.

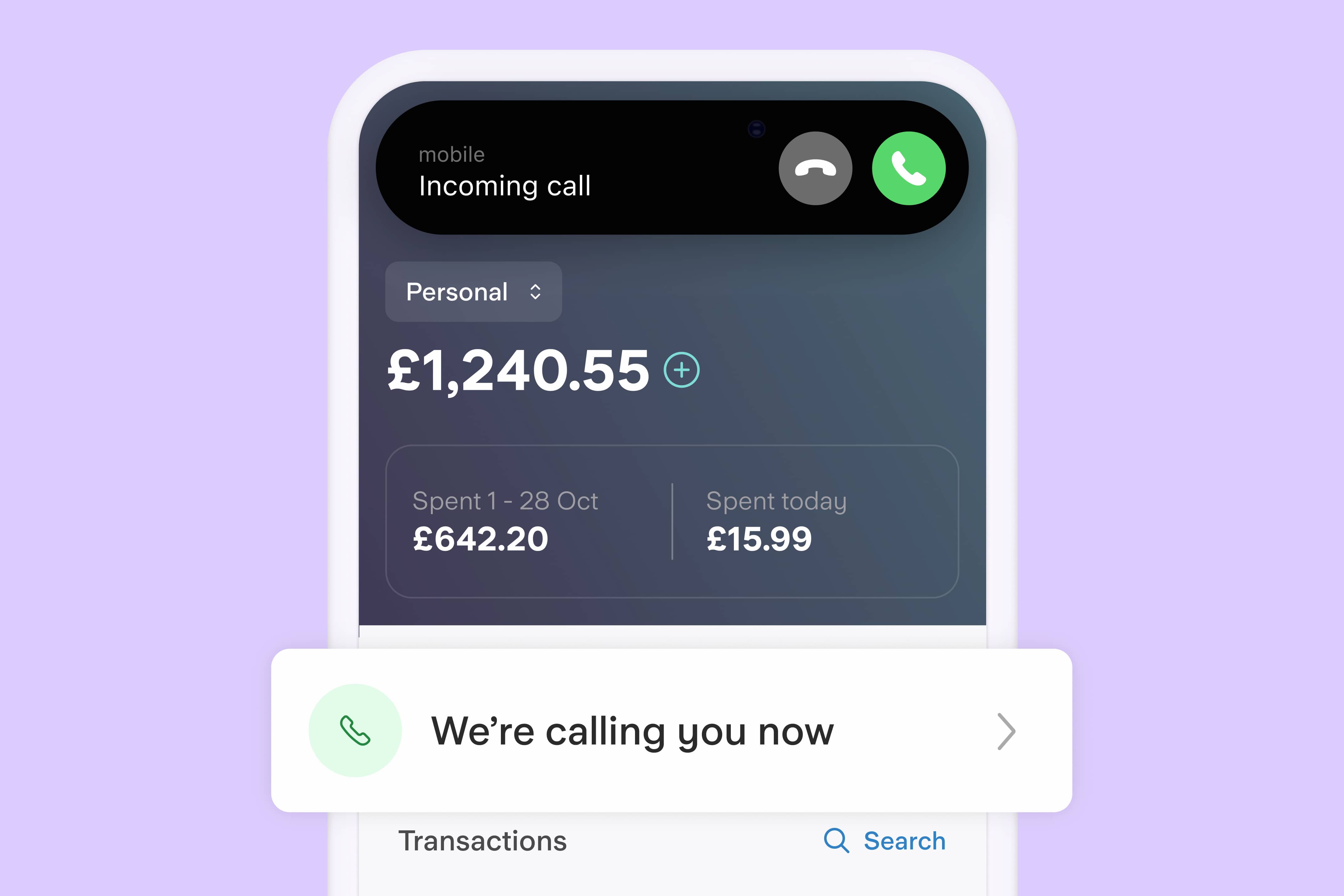

Call status indicators. This lets you know when a call really is from Starling, helping to protect you from bank impersonation fraud.

Confirmation of Payee. This helps you confirm that the name on the account you are paying is who you think it is.

Virtual cards. Keep your main card details private and your bank balance safe by using a virtual debit card when shopping.

Peace of mind

As you’d expect from your bank, your eligible deposits up to £120,000 are protected by the Financial Services Compensation Scheme.

Making sure your data stays safe

No one but you should be able to access your personal information, so we’ve built controls across the entire bank to make sure your personal data stays safe, secure and compliant with UK GDPR.

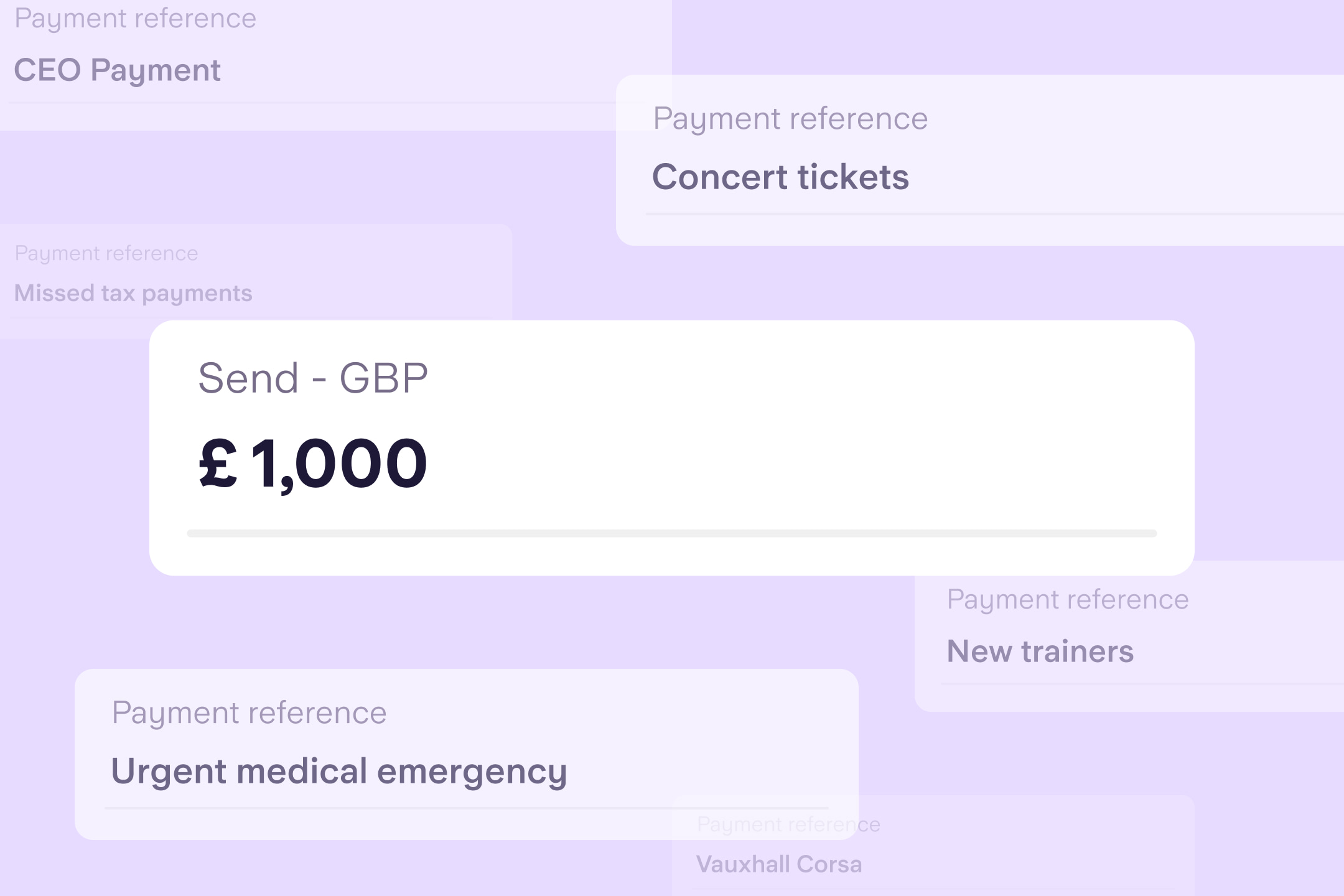

Fighting fraud

Financial fraud has become very sophisticated and these crimes can have a devastating impact on victims. We consider it our responsibility to educate customers on the types of scams we know to exist, and how you can spot these.

Find out more about how to protect yourself against fraud