Breeze through payroll with Bulk Payments

Breeze through payroll with Bulk Payments

Say goodbye to sending payments one by one, again and again. Use Bulk Payments to make or schedule multiple payments in one go, and make light work of paying staff or suppliers. Try it for free for your first month, and then pay just £7 per month.

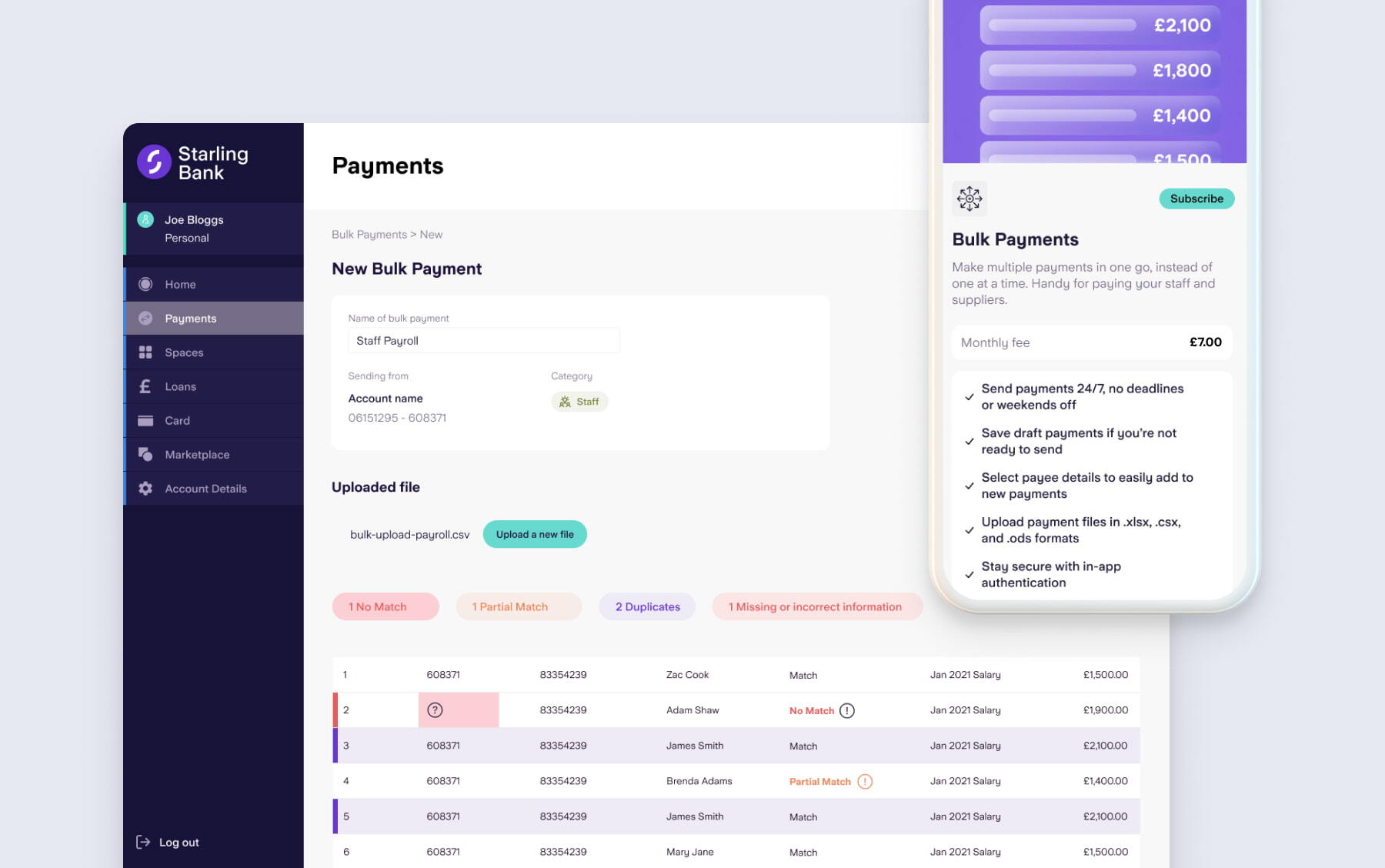

How it works

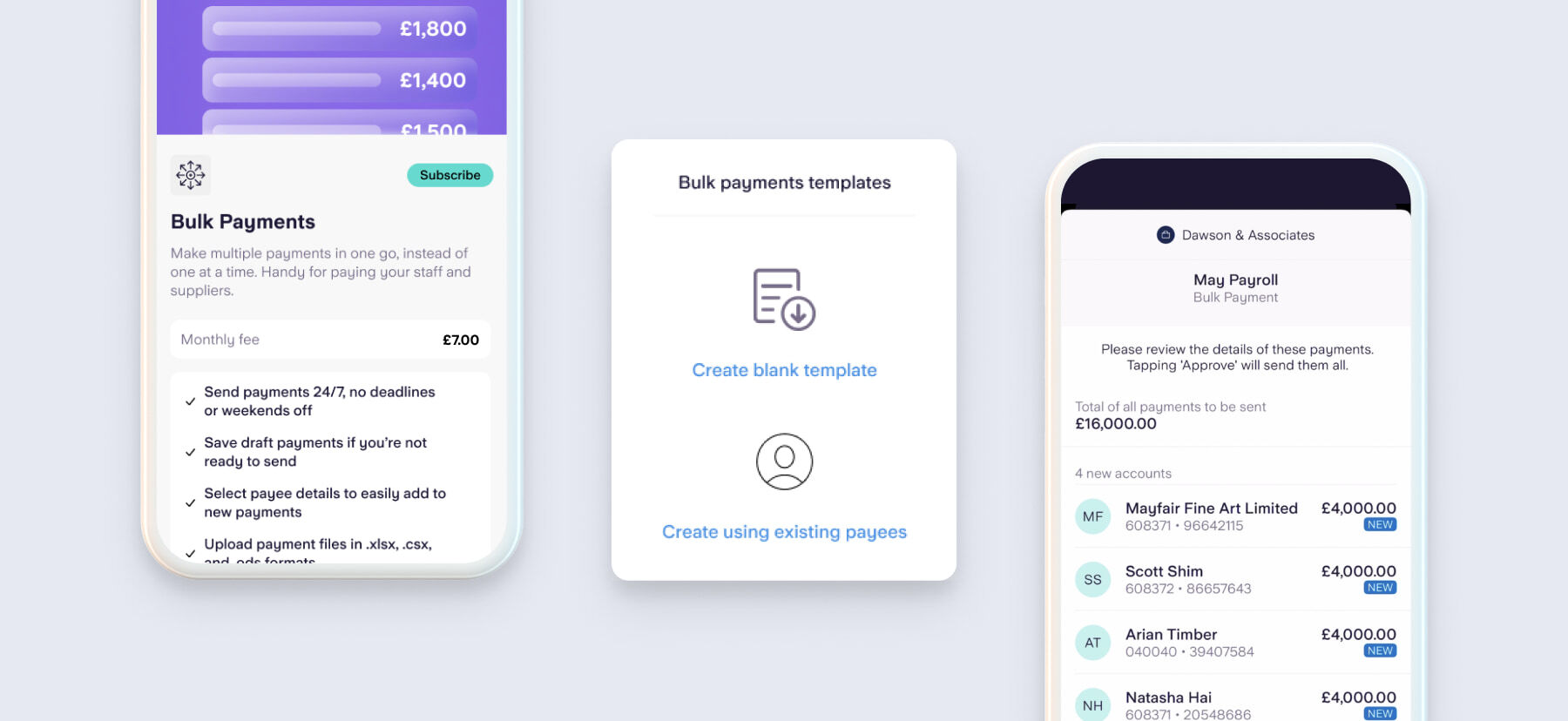

Bulk Payments is a subscription you can add onto your GBP business account, which lets you make multiple payments in one go - instead of one at a time. You can send up to 250 payments each month and upload multiple files as long as the total number of payment entries across these files is not more than 250 line items. This feature isn’t available yet for sole traders.

Send payments 24/7, with no deadlines or weekends off

Save draft payments if you’re not ready to send, or schedule them up to the end of the following month

Select existing payees to easily create your payment file

Upload payment files in .csv, .xsls and .ods formats

Stay secure with in-app authentication

All accessible through our easy to use Online Banking platform, with just a final confirmation on your phone.

Try Bulk Payments for free!

Your first month is on us. There’s no need to commit, and you can cancel at any time. Just remember to cancel before your first month is up to avoid being charged. After your first month, it then costs just £7 a month. See how the free trial works in our FAQ, or read our full T&Cs.

Show me how

What Bulk Payments can do for you

Save you time

By streamlining your financial admin, you’ll free up time you can spend elsewhere.

Check you’ve got payee details right

We’ll check they match up with the receiving bank, and highlight any areas where there could be a mistake.

Give you peace of mind

You’ll authorise all payments before they’re sent, so you’re always in control

Four steps to send a Bulk Payment - we’ll handle the rest

Sign up for Bulk Payments in the ‘Subscriptions’ area of the app.

Log in to Online Banking and head to the ‘Payments’ tab, then click ‘Bulk Payments’.

Add any existing payees to the template, then download it and enter the rest of your payee details.

Upload your file and confirm your payment using your phone.

What you need to know

How much does Bulk Payments cost?

£7 per month. This fee is VAT-exempt. You’ll be charged on the first day of each month and you can cancel at any time.

How many payments can I send?

A single payment entry in a Bulk Payment file cannot be more than £250,000.

You can send up to 250 payments each month and upload multiple files as long as the total number of payment entries across these files is not more than 250 line items. For example, if you upload one Bulk Payment file with 250 payment entries on the first day of the month, you won’t be able to upload any more Bulk Payments until the next month.

Who can use it?

For now, only our business account customers (GBP) can subscribe to Bulk Payments. It’s not yet available to sole traders.

Can I schedule payments in advance?

Yes, you can schedule payments up to the end of the following month. For example, if you’re setting up the payment in August, you can schedule the payment for any day up until the end of September.

When will I be charged after starting my free trial?

If you sign up for the free trial, you won’t be charged right away. You’ll only start paying after your first full month. For example, if you start your trial on 15 January, your first payment of £7 will be taken on 1 March. Payments are taken on the 1st of each month, so depending on when you start, your trial could last slightly more than 30 days.

How long do Bulk Payments take to process?

Bulk Payments are sent as individual payments, and most of them will land in your payees’ accounts instantly or on the date selected. But, if we spot something that doesn’t look right with a particular payment, we’ll need to check it out first, this helps to keep your money safe from fraud. We’ll make sure to notify you if this happens.

Can I use it with any payment system?

Bulk Payments only supports GBP payments using the Faster Payment network.

Want to know more?

Find out more about Bulk Payments in our FAQs. You can also check out our blog post on Bulk Payments.

Get more out of Starling

Already got a business account? Why not add a personal account to your lineup? You’re already all set up, so you can apply in a few taps.

Find out more