We’ve made some changes to how we look. See what’s new

Joint Current Account

Open a joint bank account online

Open a joint bank account online

Sorting bills, setting aside money for shared goals or just splitting the dinner tab: it’s easier with a joint account.

Apply now

Simplify household expenses.

Pay your shared bills together. Instead of a complicated combination of responsibilities – or one person doing it all – you’ll both get full visibility over any expenses and your money.

Set up Bills Manager from your joint account. Money for your bills will automatically be set aside – and paid – from a separate Space.

Apply now

Hassle-free spending.

Whose turn is it to fill the car up this week? Leave IOUs behind, and use your joint card when you spend on shared items and experiences.

You can track your shared spending habits with Spending Insights, and we’ll send you both instant notifications when you receive money, or either of you spend. And you can set a low balance warning so you both get notified if you hit it or dip below – keeping you both on top of your money.

Apply now

A Starling joint account makes life easier

100% digital sign up (goodbye branches)

24/7 UK-based customer support

Organise your money with shared Spaces

No fees overseas

Set a low balance warning, and get notified if you hit it or dip below

Spending Insights and analytics

Lock your card in the app for added security

Round Ups: set aside the change from every transaction into a Space of your choice

Your money is protected by the FSCS up to £85k

Deposit cheques by taking a photo

Organise and pay bills with Bills Manager

Help kids manage money with Kite – a debit card and app for kids managed from your joint account

How to open a joint account

Opening a joint account is easy – and all online. Do either of you bank with Starling already?

Step 1

To open a joint account, you’ll both need our award-winning personal account first. It only takes a few minutes to apply for one – all from your phone.

Step 2

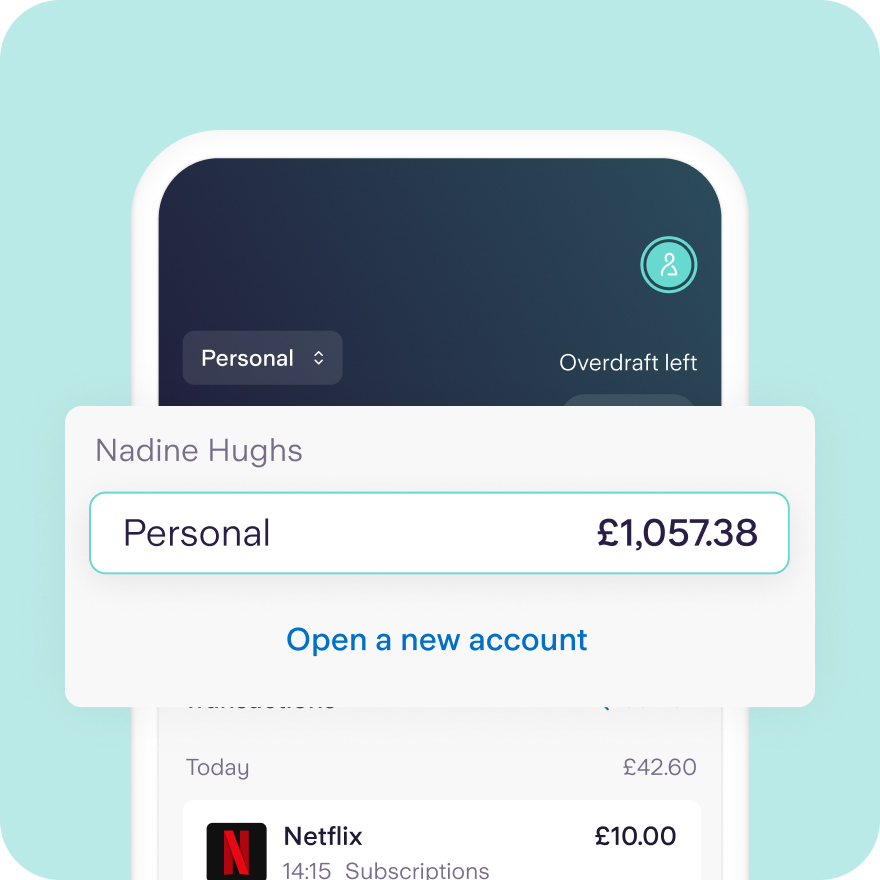

Personal accounts set up? Make sure you’re both in the same room, then tap the account switcher above your balance. Tap Open a new account.

Step 3

Choose the joint account, then follow the steps to apply. As soon as we’ve checked your details, your new account will be open and ready to use.

Subject to eligibility criteria: the option to apply for a joint account in the app will only be available for customers 18+ and that match our criteria.

Switch your joint account today.

Have a joint account with another bank? Transfer Direct Debits, standing orders, money and payees all in one go. Any money sent to your old account is automatically and instantly forwarded to your Starling joint account.

Once your joint account is open, hit the Switch to Starling button in the app to get started. We’ll handle the rest.

Frequently asked questions

What is a joint account?

Monthly food shop? Or just dog toys? Whatever you need to set aside money for, combine your efforts with a joint Space. Add a picture, set targets, and make it yours – together.

You’ll both have full access to the account and everything that’s in it. You’ll both be accountable for any of its debts too, and will share a credit history.

Is a joint account right for us?

It goes without saying that a joint account is for people who know each other pretty well, such as couples. Make sure to talk about what will happen to the account if you were to split up, to avoid having to raise a dispute in the future.

What age do I need to be to open a Starling joint account?

You can apply for a Starling joint account as long as you’re 18 or over.

Does a joint account affect my credit score?

When you open a joint bank account with someone, your credit histories will be linked. This means your credit score will be affected by theirs – and vice versa. Give this blog post a read before you consider opening a joint account.

What do I need to open a joint bank account?

You’ll both need to have Starling personal accounts, and be in the same room when starting your joint account application. Tap on your profile at the top right of the home screen and click ‘Open a new account’. Then tap ‘Joint account’ and you’ll be prompted to ‘Find them now’.

Who owns the money in a joint bank account?

Both account holders; both can make deposits and withdrawals.

How many people can open a joint bank account?

Two Starling personal account customers can apply for a joint account in minutes, without filling out any paperwork.

How do I switch my joint account to Starling?

Once your Starling joint account has been opened, tap the plus symbol by your balance. Tap Switch to Starling and follow the instructions. We’ll make the switch within seven days.

How do I close a joint bank account?

You’ll need to send us an in-app message to tell us you’d like to close the account. You can also call us on 020 7930 4450, or +44 (0) 207 930 445 if you’re abroad.

We only need consent from one account holder to close the account, unless there is an open dispute on the account.