Fixed Saver

Fixed Saver

Set money aside for a year in just a few taps, and earn 3.80% AER/gross interest in a Fixed Saver.

*18+, UK residents. Interest paid at the end of the term. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

Future plans, future-proofed.

Saving for a big future purchase? Or have spare cash you won’t need to dip into for a while?

Lock any amount from £2,000 up to £1,000,000 into a 1-Year Fixed Saver, and we’ll reward you with a return of 3.80% AER/gross. A Fixed Saver is managed from the Spaces section of the app, but remember: you won’t be able to access your money for one year.

Covered by the Financial Services Compensation Scheme, up to £85,000 across all your Starling accounts.

Grow your savings hassle-free

Secure. Fix a rate of 3.80% AER/gross interest, and know exactly how much you’ll save by this time next year. With Starling, your money is covered to £85,000 by the FSCS across all accounts.

Easy. Already a Starling customer? Apply for a Fixed Saver in a few steps, from the Spaces tab of the app. Not a customer yet?

Tidy. No more juggling multiple bank accounts: it’s all managed from one seamless app.

Fixed Savers are not available to all customers. If they’re available to you, then you can apply for one in the Spaces section of the app or through Online Bank.

You can’t top a Fixed Saver up once it’s been opened, but you can have multiple Fixed Savers at once. There’s a minimum deposit of £2,000 for each.

But just to be clear: your funds will be locked away for a year; you won’t be able to access this money. Make sure you’re covered for unexpected circumstances by keeping some of your money in an account with easy access.

Get saving in just a few taps

Starling customer already? Apply for a Fixed Saver directly in the app:

Fixed Savers are not available to all customers. If they’re available to you, then you can apply for one in the Spaces section of the app or through Online Bank.

Read terms and conditions.

Read key information in our summary box.

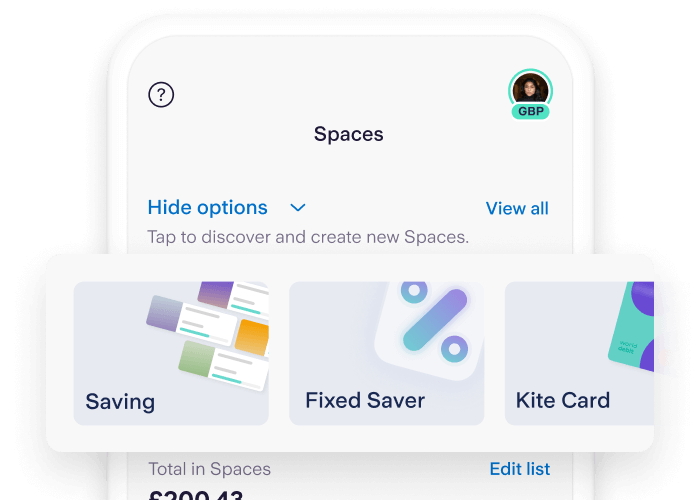

Step 1

Head to Spaces, then choose Fixed Saver from the list of Space types. You may need to tap Show Options at the top to see them.

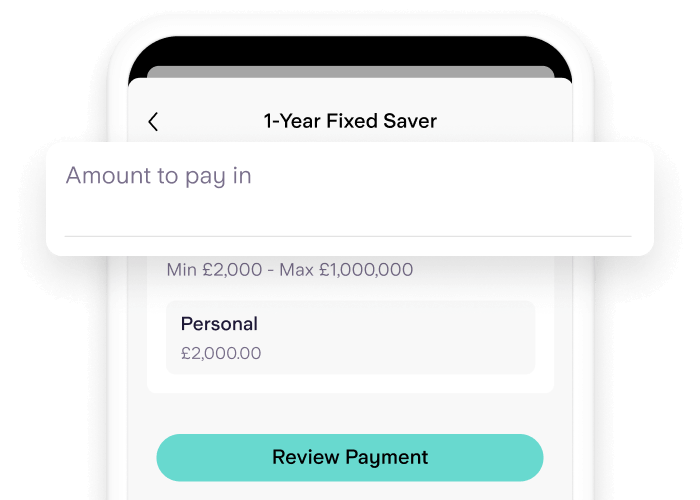

Step 2

Fill in a short application and tell us how much to put aside. The minimum deposit per Fixed Saver is £2,000, and the maximum is £1,000,000. Bear in mind you can’t change this amount or add to it once your Fixed Saver is open.

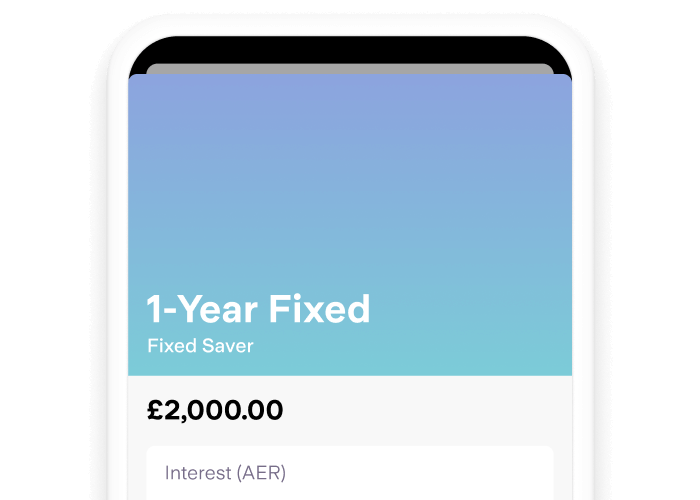

Step 3

If approved, we’ll transfer the money from your main balance to your Fixed Saver. Remember, your money is locked away for a year, and you won’t be able to access it.

New to Starling? You’ll need our award-winning current account before you can apply for a Fixed Saver. It only takes a few minutes to apply, and it’s done entirely from your phone. Then, just follow the steps above to get a Fixed Saver.

Apply for a current accountHow much will I earn with a Fixed Saver?

| Value after one year | Interest earned | Interest rate (AER) |

|---|---|---|

| £2,076.00 | £76.00 | 3.80% |

Fixed Gross/Annual Equivalent Rate (AER): 3.80%. These calculations are for illustrative purposes only. Terms and conditions apply.

Compare accounts

Is an Easy Saver or a Fixed Saver right for you?

| Features | Fixed Saver | Easy Saver |

|---|---|---|

| Interest rate | 3.80% AER/gross fixed | 3.75% AER 3.68% gross variable |

| Interest paid | End of term | Monthly |

| Access to funds | No access for 12 months | Unlimited access |

| Account term length | 12 months | N/A |

| Minimum and maximum deposit | £2,000 – £1m | £0 - £1m |

| Number of accounts you can open | Up to 50 | 1 |

Summary box

Applicable to Fixed Savers entered into from 10:00 on 10 June 2025. This Summary Box is a summary of the key features of the Fixed Saver account. Please read the terms and conditions that apply to the account.

Account name

1-Year Fixed Saver

What is the interest rate?

Gross/Annual Equivalent Rate (AER): 3.80%

Interest is calculated every day, and paid at the end of the term.

The Annual Equivalent Rate (AER) shows what the interest rate would be if interest was paid and compounded once a year. It’s used to help you compare between savings accounts.

The ‘gross’ rate is the actual rate we’ll pay. Paying gross interest means we don’t deduct any tax you might owe.

Can Starling change the interest rate?

No, the interest rate will stay the same for the full one year term.

What would the estimated balance be after 1 year based on a £2,000 deposit?

Interest rate (AER): 3.80%

Balance after one year: £2,076.00

The estimated balance is based on £2,000 deposited into your account on the first day of your account opening. The estimated balance assumes interest will be added to the account balance at the end of the term.

This estimation is provided for illustrative purposes only.

How do I open and manage my Fixed Saver?

To open a 1-Year Fixed Saver:

You must have an open Starling personal current account.

You must be aged 18 and over.

You must be a UK resident.

As we are a regulated bank, you also need to go through some additional eligibility and fraud checks. We’ll use the personal information we hold for you to complete these checks. If you need to update any of these details, make sure to do this before submitting your application.

You will also need to pay in a minimum deposit of at least £2,000.

You can hold up to a maximum deposit of £1,000,000 across all the Fixed Savers you may have.

You can open and manage your Fixed Saver in Online Banking or the Starling app.

Can I withdraw money?

No, you can’t move your money until the end of the 1 year term.

At least 14 days before the term of your Fixed Saver is due to end, we’ll send you information about what happens at the end of the term.

Additional information

Your Fixed Saver is for personal use only.

You can cancel your Fixed Saver within the first 14 days of opening it and we’ll return your money without interest.

The Annual Equivalent Rate (AER) shows how much interest you’ll earn after a whole year.

We pay ‘gross’ interest, which means we don’t deduct any tax you might owe. You may benefit from a Personal Savings Allowance that varies depending on your other sources of income. Further information can be found here: https://www.gov.uk/apply-tax-free-interest-on-savings

You can access a tax certificate statement in the app and may need to declare the interest you earn on this product in your self-assessment tax return.

The tax treatment is dependent on your individual circumstances and may be subject to change in the future.

Previous rates

4.05% Gross/AER - 19/09/2024 to 10/06/2025

4.20% Gross/AER - 15/08/2024 to 19/09/2024

4.48% Gross/AER - 12/01/2024 to 15/08/2024

5.00% Gross/AER - 20/12/2023 to 12/01/2024

5.36% Gross/AER - 23/11/2023 to 20/12/2023

5.53% Gross/AER - 21/09/2023 to 23/11/2023

5.25% Gross/AER - 03/08/2023 to 21/09/2023

3.25% Gross/AER - 15/12/2022 to 02/08/2023