Try Toolkit for free

Unsure if it’s right for your business? Take a month to decide.

There’s no need to commit, and you can cancel at any time. After your first month, it then costs just £7 a month.

Manage your invoices, bills, tax, VAT and more from your bank account, all for just £7 a month.

There’s no need to commit, and you can cancel at any time. After your first month, it then costs just £7 a month.

Save time.

Spend less time sorting through invoices and receipts – and more on what you’re good at.

Keep track.

Toolkit will help you stay on top of tax, invoices, bills and more.

Stay organised.

When your banking and bookkeeping are all in the same place, life becomes that little bit easier.

Tailor-made features.

Whether you’re a freelancer, self-employed, or small business, Toolkit’s features simplify the extra financial admin.

“It’s really easy to see what’s in the process of being paid, what’s done and what’s still outstanding.”

Create and seamlessly send invoices directly from your desktop, and connect your online banking to your email. When you get paid, just match your invoices in a single click.

View a dashboard of all of your invoices to stay on top of your cash flow.

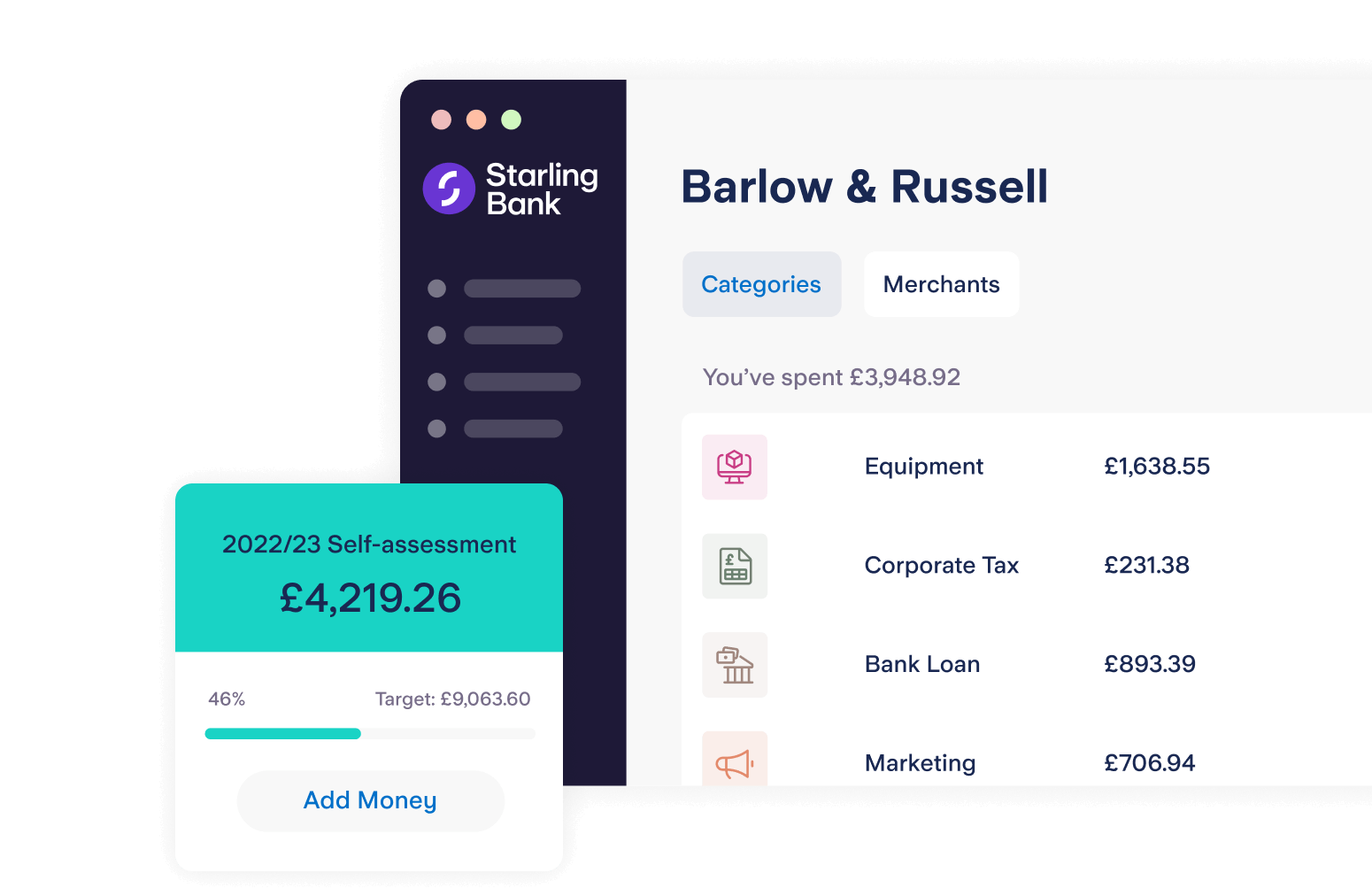

We’ll automatically categorise your transactions with useful spending categories and tax allocations. See handy hints in the category description to help you understand what is and isn’t allowable for tax.

Good news for sole traders: see an up-to-date estimate of the money you need to save for the self employment part of your tax return. You can then set it aside with just one tap.

We calculate an estimate using cash accounting. This is suitable for most self-employed sole traders earning less than £150,000 per year.

Record VAT on your transactions, and set defaults if you’re happy to automate some of it. Connect to HMRC and submit your returns through Making Tax Digital.

✓ Cash Accounting Scheme

✓ Flat Rate Scheme (cash basis)

We don’t currently support other VAT schemes.

The Business Toolkit lets you upload bills as soon as you receive them and schedule payments to help you manage your cash flow.

No more sleepless nights over invoices, tax or VAT. Starling will always show you what needs to be done in a handy interactive to-do list, so you can stay on top of your admin.

Sole trader, contractor, chief wearer of many hats – however you describe what you do, your life could be made easier by the Business Toolkit.

Spend less time sorting through invoices and receipts – and more on what you’re good at.

Manage things like bookkeeping, bills, VAT and self-assessment tax, directly from your bank account.

But don’t want the expense or commitment of a separate accountancy package.

Good news for those of you on the Cash Accounting Scheme or the Flat Rate Scheme (cash basis): both are compatible with the Business Toolkit.

For the time being, the Business Toolkit is available in online banking only. This means you can log in to your account on your desktop or laptop and manage your books from there.

Business Toolkit Features | No | No |

|---|---|---|

Invoices and auto-matching Create and manage unlimited invoices directly from your desktop. When you get paid, just match your invoices in a single click | No | |

Email integrations Link your Google, Outlook or Hotmail email to the Business Toolkit to issue invoices directly from your bank account | No | |

HMRC Tax estimation (sole trader only) Estimate your self-employed tax (SA103F), national insurance and student loan liabilities | No | |

Record VAT on transactions Record your VAT, and we’ll calculate your VAT return if you’re on cash accounting or flat rate (cash basis) | No | |

Smart tax savings Set aside money for your self-employed tax and VAT bills in a click | No | |

MTD VAT submission Connect your account to HMRC and submit your VAT return through Making Tax Digital | No | |

Bookkeeping to-do list See what needs to be done in a handy interactive to-do list, so you can stay on top of your bookkeeping admin | No | |

Manage bills Upload bills, schedule payments and track your expenses. Auto-sync Direct Debits from Spaces | No | |

Starling Original Features | No | No |

Free UK current account Starling is a registered bank. Up to £85,000 of your eligible deposits will be FSCS protected | ||

Multi-director access Manage an account with the other directors of your business | ||

Integration with accounting software Link your account with QuickBooks, Xero or FreeAgent | ||

Free UK bank transfers Send and receive pounds within the UK, completely free of charge | ||

International payments Make payments to 30+ countries with real-time exchange rates and no hidden fees | ||

No debit card fees abroad Use your Starling card on business abroad, with zero fees | ||

24/7 UK support Get in touch, wherever you are, via phone, email or in-app chat | ||

Automated business categories We’ll put your expenses into relevant business categories for you | ||

Receipt capture Add receipts to transactions while you’re on the go | ||

Spaces Set aside money towards your business goals | ||

Apple, Google, Samsung and Garmin Pay Pay with your mobile or smart watch | ||

Mobile and online banking Manage your finances at home, in the office or on the go | ||

Mobile cheque deposits Pay cheques in via the Starling app and receive the funds within two working days | ||

Cash deposits Pay in cash at your local Post Office, there’s a 0.7% charge (minimum charge of £3) for each deposit | ||

ATM withdrawals £300 fee-free every day, at home or abroad | ||

Card control Freeze your card in the app if you lose your card on the go | ||

Instant notifications We’ll let you know whenever you get paid or spend from your account | ||

Connect to other business services Access a range of products and services in the Starling Business Marketplace that you can link to your business or sole trader bank account | ||

Bills Manager Get a clearer view of your money by paying Direct Debits and standing orders from a separate Saving Space. |

Existing customer? Apply for the Business Toolkit in-app by navigating to the subscription section in your account menu.