Personal finance

Looking after your finances, looking after your mental health

5th November 2025

It can be argued that financial anxiety is a by-product of the way that you respond to a situation, not always just a result of the situation itself. Focusing more on what you can control positively, and less on what you can’t, may help reduce anxiety.

There are things within your control that can affect your finances. These may include deciding what to spend money on, budgeting and learning new skills. There are also many ‘big picture’ issues of concern, which you can’t directly influence. These include the economy, taxes, furlough and the stock market.

Here are a few ideas on positive actions:

Money is still a taboo subject for many. It can be hard to open up to others about financial worries. But isolation can make feelings of anxiety worse. Opening up to someone you trust and experiencing empathy, may reduce anxiety levels and could help you gain more perspective on the situation.

Debt is one of the biggest sources of financial anxiety. Getting out and staying out of debt is important for your financial wellbeing. Seek out help to put together a debt management plan which enables you to get on top of repayments, and start building resilience to avoid using credit going forward. As soon as you think there’s a problem, talk with your bank and credit organisations. Stepchange is one recognised organisation that provides a free debt advice service.

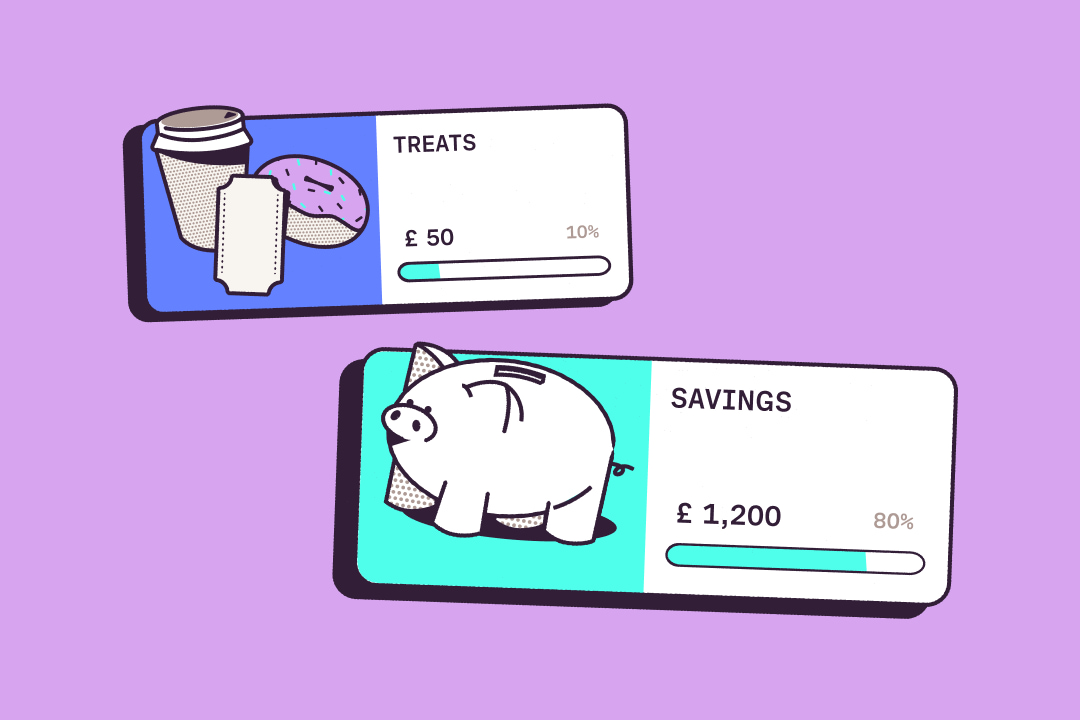

An emergency fund can help protect you from financial shocks. Build a savings buffer to use for unexpected expenses. Start small and build as you can. Within the Starling app, the Spaces feature helps you ring-fence money from your main account. You can set it to automatically round up transactions, so when you spend money, the change gets added in. For longer-term saving, you can use our Fixed Saver. Lock away savings for a year, and earn interest in return.

Writing down 10 things you are grateful for, before bed, is a great positive practice. Focus on the things in your life that bring joy and avoid the negative. Research shows this practice improves sleep quality. Why not try this, if financial worries affect your sleep.

Social media makes it hard not to compare our lives to the lives of others. Remember though, we never know the true story behind the feed. Remove the temptation to compare - delete or block the social media contacts who trigger that.

Write a list of the things that make you feel amazing and don’t cost a thing. From walks in the fresh air to calling your loved ones. Keep it handy so you can easily turn to the list when you need a boost.

Financial problems don’t go away by themselves, so don’t ignore them. Draw a line in the sand and take action. One of the ways to help get your personal finances right is budgeting. Our online Budget Planner helps you to get an overview of your spending.

Take a good look at what you spend each day, week and month. The Starling app also provides spending insights, which can help with understanding how you’re spending your money, so you can plan a budget.

The Money Advice Service has all kinds of useful resources to explore, and can offer free financial guidance.

Always be aware of the impact of your conversations and actions on children. It’s best to avoid discussing finances in a negative way in earshot of children, or having age-inappropriate discussions about money with them. In their early years especially, sharing positive messages with kids is really important. It could help them to have a better relationship with money in later life.

Read other articles in our Money Explained series.

The above article is intended as general information and does not constitute advice. You should take independent advice if you have any questions about your specific circumstances.

Personal finance

5th November 2025

Team Starling

5th November 2025

Personal finance

15th May 2024

Money languages

19th December 2025

Money Masters

19th December 2025

Money Masters

11th December 2025