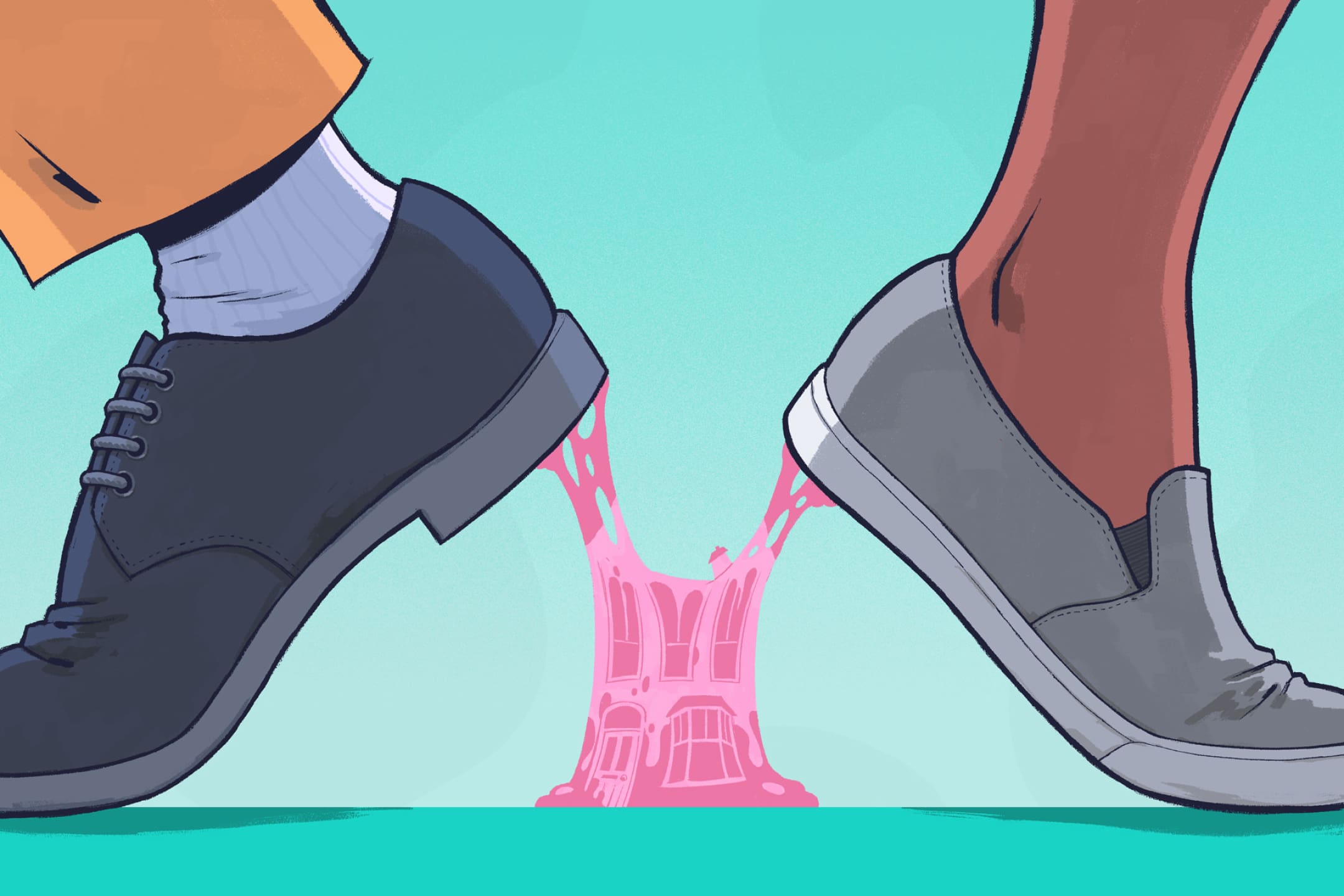

Property

Otegha Uwagba on homeownership

By Otegha Uwagba

For What It’s Worth

My marriage is over, but my wife and I can’t go our separate ways because we don’t have the money.

We get on fine on a day-to-day basis, but we aren’t in love anymore. However, we live in a nice area — which pushed us to the limit mortgage-wise — with a lovely son in a lovely school.

If we split up, I don’t know where we’d live. Selling the house wouldn’t leave us with enough for two deposits, as we’ve not paid much of the mortgage off, and as individuals we would fail affordability checks.

We both love being parents, so we’d each need a place big enough for our son to live there half the time. The only way we could do it would be to move to a neighbourhood that’s not as nice – and rent.

We live in a wonderful area for a kid to grow up in. Splitting up would be disruptive enough — changing schools and moving away from his friends would just add to it all. And leaving the property ladder feels irreversible.

My wife and I are in agreement that our son’s welfare comes first. For now at least, we can raise him as platonic co-parents; friends with the same goal. And we’ll just have to see what happens financially.

In an ideal world, we’d buy the house next door. Then we could co-parent, each see our son all the time but also be free to move on romantically (currently out of the question). But we’re not in an ideal world!

I resent that it’s money — and our lack of it — that dictates how we live. But it’s not an awful life, it’s just one that doesn’t have everything we want. And, ultimately, who has everything they want?

Even so, it’s made money incredibly complicated, emotionally. If I got a big raise or came into a large sum, it would just take us to the next messy, sad step in the end of our marriage. And that would be hard to celebrate.

Illustration credit: Emanuel Santos

What are affordability checks?

Affordability checks are the reviews carried out by a lender as they decide whether or not to grant you a loan, mortgage or other form of credit. They are designed to check whether you can realistically pay back the loan, mortgage or credit you’ve applied for.

When two people apply to borrow money as a pair, for example if a couple applies for a joint mortgage, the lender runs affordability checks on their combined income, expenses, credit score etc. If accepted, both people in the couple will be responsible for making mortgage repayments, even if they split up.

If one person wants to move out and give up their share of the property, the other can look to buy them out, if they can afford it, then apply for a new mortgage as an individual. However, there are no guarantees that they will pass the affordability checks on their own with a single income and the couple will usually need to pay an exit fee for coming out of their joint mortgage agreement earlier than planned.

If life takes an unexpected turn and you find yourself worrying about money, Starling customers can reach out to our Welfare team. They’ll be able to lend an ear and guide you towards free and independent advice.

Support with money worries

Property

By Otegha Uwagba

Money truths

By Justin Quirk

How Much Does It Cost?

By Hannah Summers

Group holidays

By Kat Storr