Trend Vetter

The Great Lock In

By Amelia Tait

Good with money

We live in a society that wants us to spend money all of the time. And one that makes it very easy for us to do so. We can spend without thinking – whether it’s a tap at the supermarket checkout or the ‘buy now’ button on Instagram. And if that wasn’t enough, there’s the cost of living crisis to face. The prices of food and non-alcoholic drinks went up by 7% between January 2023 and January 2024, meaning that the impulse chocolates you bought at the cinema could now cost you close to £5.

To combat this never ending battle, a few days a month I try not to spend anything. The cost of living crisis is not our fault and not in our control, but deliberately using what I already have and deciding not to spend feels like I’m beating the system. I’m opting out of being what I like to call a zombie consumer. On the days I spend nothing, I feel free.

That’s the beauty of opting out of spending completely: you start to really see just how much of our lives are spent consuming. The days where I spend nothing also help me budget overall – it forces me to appreciate what I already have.

Chances are you don’t need to buy something new everyday, if you’re lucky you probably already have what you need in your cupboard. The average UK household throws away nearly £7 worth of uneaten food every week. As a country we’re throwing away 680m items of clothing every year and in 2023 half a billion cheap electrical items went into UK landfills.

Today, I have pasta and cans of tomatoes in my cupboard. I have trainers. I have books and a free podcast. My phone can stream me hours of entertainment. Despite often feeling that I have “nothing to wear”, I have more than enough clothes. Socialising can also be a TV date or a walk in the park, it doesn’t always have to be based around consuming.

Many are calling this ‘underconsumption core’, the trend where influencers are pushing back against consumerism by encouraging followers to repair or repurpose their stuff.

‘Spend nothing days’ have helped me see how often I buy something for the endorphin hit I get from spending, rather than any need or want. Bored at work = a coffee shop visit. Just seen a picture of a successful ex colleague = cut to me filling a basket with clothes that will change my life. Stressful day = I deserve a takeaway. But the endorphins are short lived.

Spending money distracts me from my real emotions for about 10 minutes and then I’m back at my desk £4.50 poorer or regretting a new mascara that I didn’t need. Setting my target as zero gamifies budgeting. I win if I don’t spend, which means I still get those endorphin hits – not from a purchase but from my own choice to opt out.

Overcoming the bombardment of spending opportunities and your own spending triggers isn’t easy. It takes determination to resist the pattern of spending money to pick you up when you’re feeling low.

By taking away money as an option to make yourself feel better, you may start to look elsewhere. I now have a long list of go-tos that I know will make me feel better instead of pressing ‘buy now’.

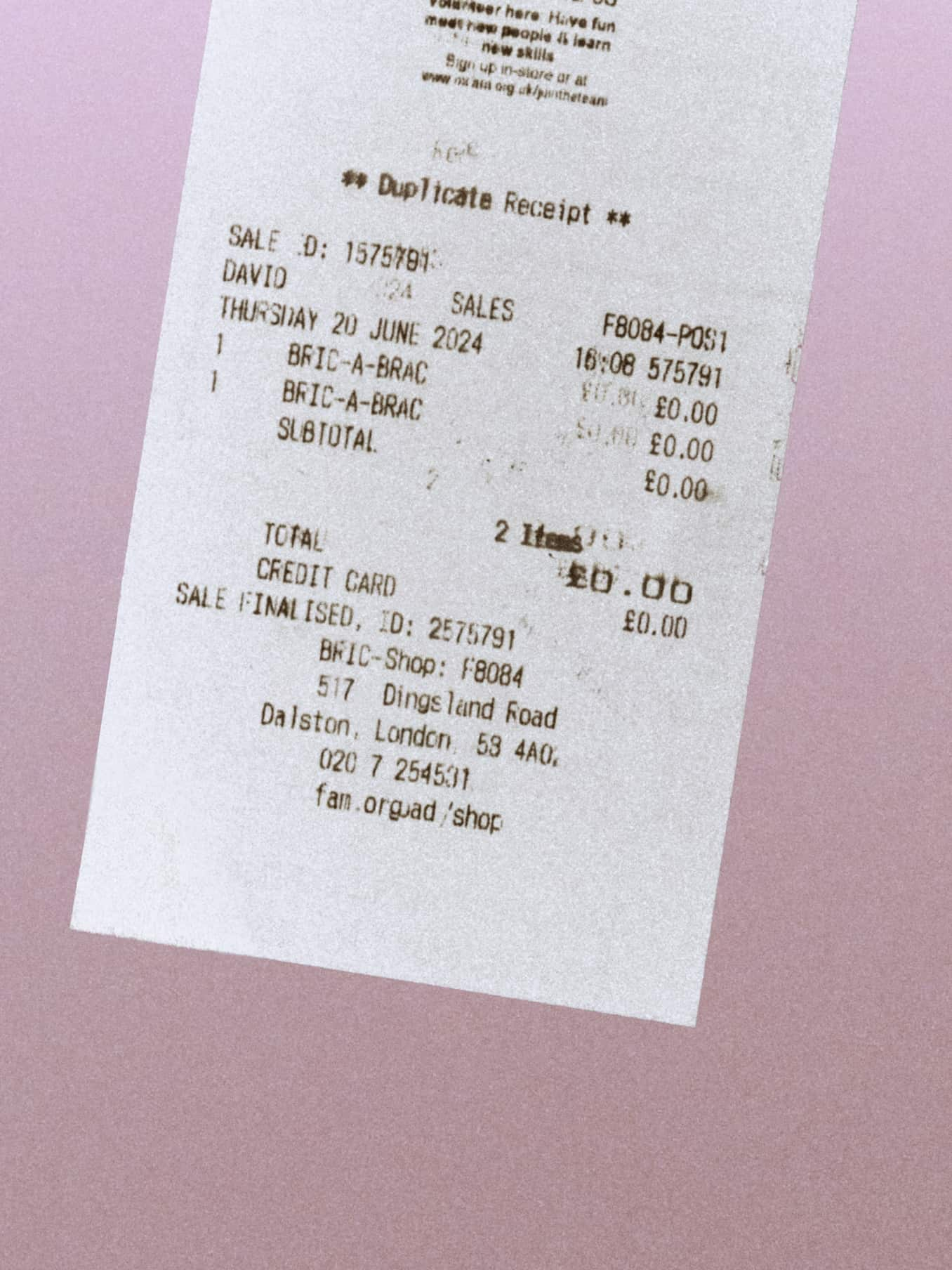

These include long baths, organising my wardrobe, taking the time to make soup from the stray vegetables at the bottom of the fridge, yoga in the park, leaving my phone in the office and going for a walk. Oh and that glorious feeling of opening up your Starling app and seeing the words ‘Spent today: £0.00.’ That makes me feel good.

Choose a day and aim to make it a ‘no spend day’

Everytime you go to spend, consider whether it’s a need or want

Compare your ‘wants’ with what you already have. Do you really need a fifth pair of jeans? Have you forgotten about that coat that looks very similar to the one you’re lusting over? What could you mend for free?

Shut down impulse buys! If you’ve got something in your basket, leave it there for 24 hours and see if you still want it

Be mindful of your thoughts – how are you feeling when you hover over ‘buy now’. What are you chasing? Think about what you consume, why, when, and who you buy from

Look through your kitchen cupboard and come up with something – like your own version of Ready, Steady Cook (remember that?)

Count up the pennies (and pounds) you wanted to spend (but didn’t) and put them towards something you really want in the future, such as a trip you’re looking forward to

Choose to walk or cycle instead of tapping your card on the bus or getting a taxi

Notice if you feel empowered – dare I say even smug – knowing you don’t need to spend money on a daily basis.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

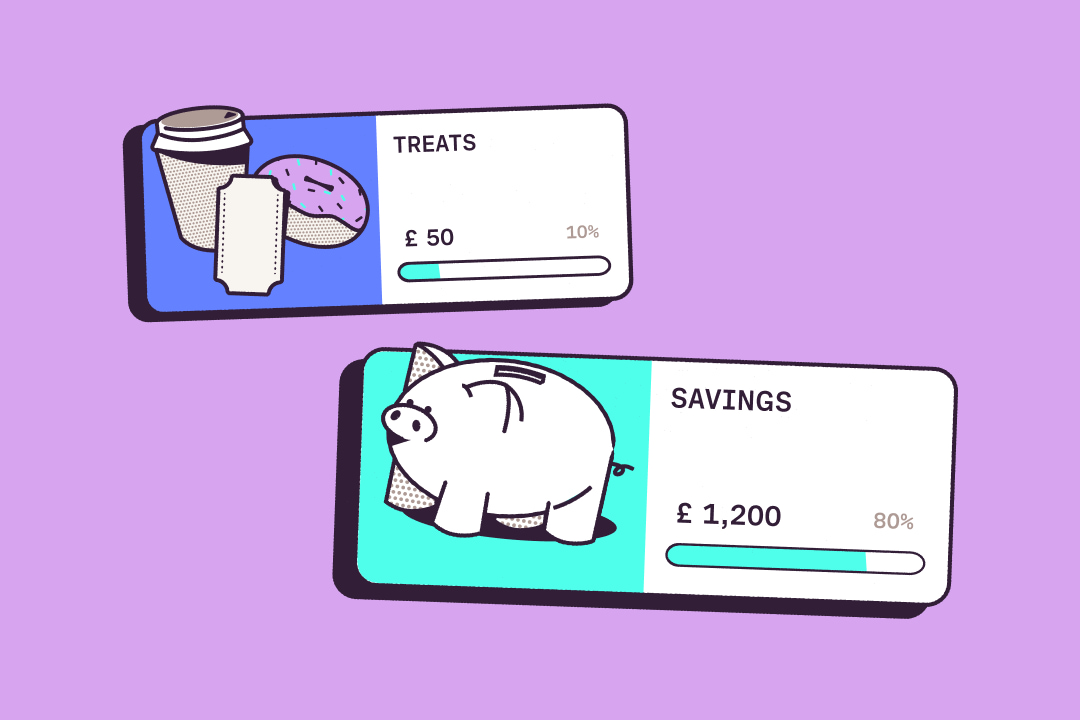

Keen to keep a closer eye on your bank balance? With Starling, you’ll get automatic Spending Insights. You’ll even be able to tag transactions as an ‘Impulse Buy’ or ‘Non-Essential Spend’.

Explore our current account

Trend Vetter

By Amelia Tait

Product news

By Team Starling

Personal finance

By Charlotte Lorimer

Team Starling

By Team Starling