Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

Saving

A friend regularly describes having a drink as “greasing the fun wheels”, something very apt now that I’ve decided not to consume alcohol for an entire month. Considering the number of social gatherings that typically take place during the festive season ‒ be that family, friends, or work-related – along with the added stress of the holidays, December felt the most challenging of the calendar year, hence why I picked it.

The other two main factors are the costs and health benefits associated with doing so – the latter of which has skyrocketed in my priorities since hitting the dreaded three-zero milestone. Less alcohol means better growth and recovery, therefore, easier to put on more muscle while the general improvement in mental well-being is hard to overlook. Naturally, in these more trying times, any financial gain is massively appealing too.

To attempt sobriety, I used two tracking apps: Try Dry and I Am Sober. This allowed me to view and calculate how much money I’m saving daily. So, what’s the downside? Missing out on potential fun thanks to FOMO (fear of missing out) constantly flickering in the back of my mind.

I’m a reasonably social person, always looking for an excuse to meet up with people but my typical routine doesn’t include drinking frequently. Rather, I will have two or three (maybe more if there are weddings or other events) big sessions throughout the month as opposed to a couple of drinks every night. Known as “binge drinking”, the sobriety-tracking apps avoid accounting for this lifestyle, so an estimation has to be given. Considering that 16% of adults in 2022 over the age of 16 were reported to have experienced binge drinking in the last week (via Drinkaware), being unable to measure this intake accurately feels quite outdated.

One of the biggest hurdles I struggled with was thinking of alternative meeting places outside of the pub. Whether it’s for a general catch-up, the chance to play pool or just watch football, it’s the place to be. It’s the go-to assembly point. It’s a staple of British culture. While back-to-back illnesses helped make avoiding alcohol for moderate lengths that little bit easier, there were a few particular occasions when I felt slightly left out. Not by friends. Not by family. Just the camaraderie of all. I didn’t feel the need to get blackout drunk, yet a couple of beers to “grease the fun wheels” would have been nice to relax more into the evening.

What didn’t help any of this is the price of non-alcoholic drinks that equate to around the same amount as an alcoholic one. A 0% Heineken has always been my go-to, helping to fill the void and avoid any awkward questions. From my experience, they cost on average £5.50 so the incentive to save is pitiful. Quickly, I moved on to the likes of Coke and Sprite. Still at £3.50 for a soft drink, it’s easy to see why more people stay home.

I’d love to say sobriety became easier as the month went on. I can’t lie, though. I was counting down the hours on New Year’s Eve. The crazy thing is that I didn’t even have a drink come midnight. It was the opportunity to regain my freedom and enjoy a glass on New Year’s Day itself that truly felt invigorating. It was even sweeter considering I opted for a pricey cocktail that my father-in-law kindly decided to buy.

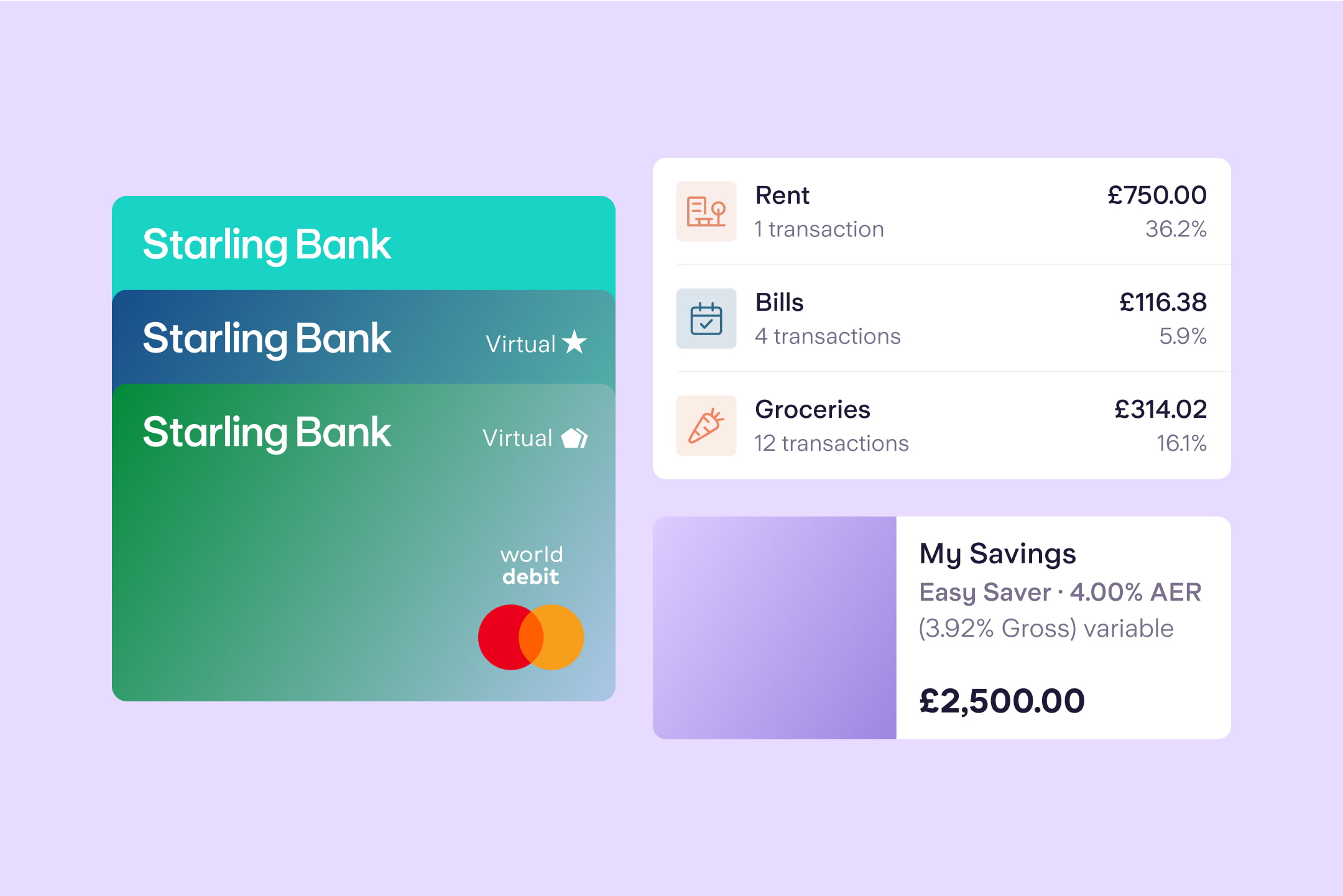

The aftermath is where the good news began to stem, such as the bonus cash saved, which I put into Starling’s Easy Saver account earning myself 4% AER (3.92% gross) variable* interest. Consequently, I managed to put away an extra £87 from not drinking alcohol alone. A projected yearly saving from that is estimated at £1,043. This doesn’t take into account the likes of travel and takeaways, which pushes that number much higher.

All of these added supplements are a factor in drinking nowadays. It was a commonly shared reason among those I spent time with that they venture out less but spend higher when they do. So instead of just going for drinks every week, they’ll go once or twice a month and look to include a meal in there as well. As you can see, this was the consensus I came across too. While I spent less on alcohol, my meal expenditure (£180.34) went up as I felt I had the extra cash to float. The result is that my bank account looked slightly healthier come the first of the month but nothing startling.

The true upside is my health. Cancer Research UK finds that alcohol causes at least seven types of cancer. By removing it altogether you can help cut the risk of early death from more than 60 serious illnesses. The NHS then lists out plenty of reasons for both the short-term and long-term, such as feeling better in the mornings, lower blood pressure, lower risk of stroke, lower cholesterol levels as well as better mood, memory and sleep. It’s hard to put a price on that value.

On reflection, I’d say the difficulty with not drinking for 31 days was more the restriction than the need to consume alcohol itself. Not to mention, the bore of having to explain over and over why I was doing so. The money aspect has made me realise that I don’t spend that much on alcohol overall, yet the package of travelling, food and such is what really ramps up my expenditure. So while I still subscribe to the idea of “greasing the fun wheels”, the need to drink until the wheels come off is something that I’ll certainly put the brakes on going forward.

*18+, UK residents. Interest paid monthly. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

Looking for somewhere to put the money you save this Dry January?

Explore our Easy Saver

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Money masters

By James Browning