Personal finance

Looking after your finances, looking after your mental health

5th November 2025

5th October 2021

A joint bank account can make it easier for two people to manage their money. For example, if you live with your partner or a good friend, you can manage household bills or shared food shops from one account, rather than constantly working out who owes what.

Opening a joint account is not something to rush into though; you need to trust the person you’re applying with.

Before applying, make time for an open conversation about money, ideally so you can talk about the following five topics: credit scores, goals, budgeting, spending habits and trust. We know it’s not always easy to talk about money but when you’re looking at linking your finances to someone else’s, it couldn’t be more important.

Credit scores measure how well you pay back debt. They can impact how much and what type of credit you can secure, including a potential mortgage.

When you open a joint account with someone, your credit histories will be linked, meaning that your credit score could be impacted by theirs and vice versa. That’s why it’s worth checking and comparing credit scores before you decide to apply for a joint account.

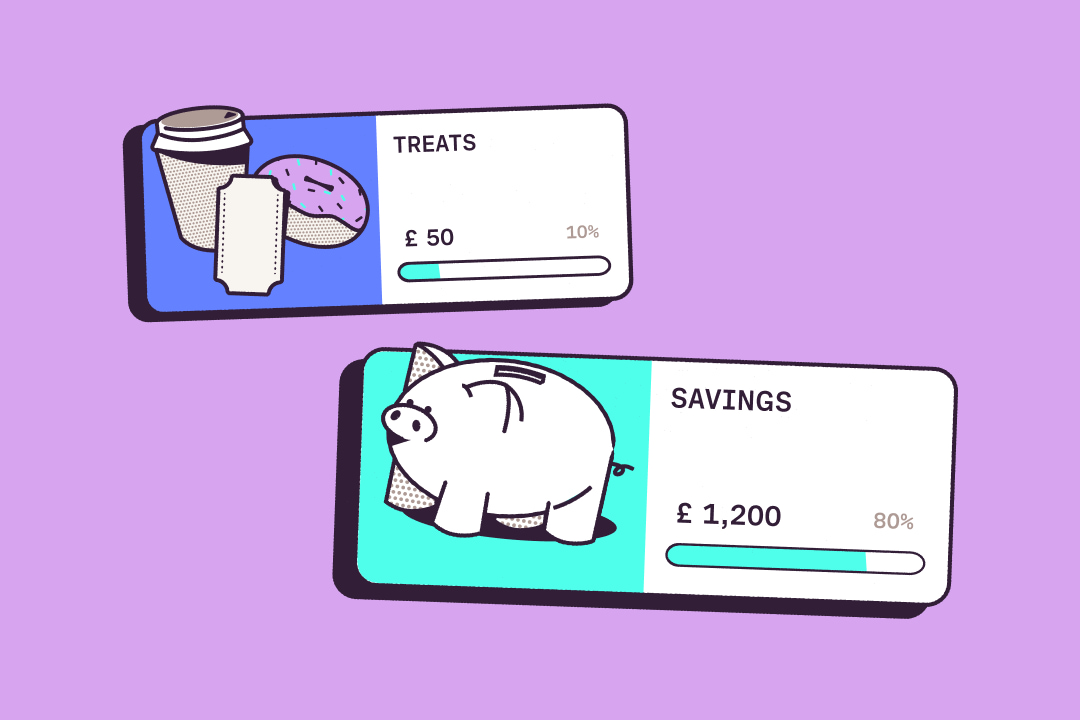

If you’re planning to renovate a co-owned flat, buy a car or go on holiday with your partner, you may want to work towards these goals together. If, after you compare joint accounts, you opt for a Starling joint account, you’ll be able to keep money for joint projects organised with Spaces. This feature enables you to ring-fence money from your main balance.

Before moving any money into a joint account, talk about the approach you want to take - will you both add the same amount into the account? Remember that both people will be able to spend whatever you put into the account, so you may feel more comfortable keeping some of your money in an individual current account or individual savings account. You could then simply move funds across for specific joint expenses, such as a holiday.

To gain more control and insight into your joint monthly spending, why not create a joint budget? To do this, calculate how much you need for essential outgoings such as rent/mortgage, electricity, council tax, WiFi and childcare.

Next, talk about how you plan to split these outgoings. Will it be 50-50, with each person adding the same amount each month? Or do you want to make payments proportional to what each person earns? For example, if you’re sharing the rent with your partner and you earn a third more than them, will you pay a third more rent?

It’s worth knowing what each other’s spending habits are before making a financial commitment to someone by opening a joint account. Otherwise, you could end up arguing about what the joint account should and shouldn’t be used for after money has been spent.

With a Starling joint account, you’ll both receive instant notifications whenever money leaves or enters the account. These notifications can prompt further conversations about spending habits once you’re up and running.

Joint accounts are for two people who trust each other. Will you be happy for someone else to see your spending? Do you think they’ll check in with you before making a large payment? It’s worth noting that if your joint account goes overdrawn, you’ll both be responsible for the debt.

Make sure that you feel comfortable talking to each other about your worries, financial priorities and goals. And keep that conversation going, especially if you decide to set up a joint account together.

A Starling joint account can be set up by two people with Starling personal accounts, straight from the app. There’s no need to visit a branch or fill out any paperwork - simply open the main menu of your Starling personal accounts, click ‘Open a new account’ and follow the instructions, all from the comfort of the sofa.

Both people listed on a Starling joint account can set up payees, make payments and spend from the account. You’ll also have full transparency of each other’s payments into the account and outgoings, which should save time on seeing who owes what for your shared holiday or house bills.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, you should speak to an independent financial advisor.

Personal finance

5th November 2025

Team Starling

5th November 2025

Personal finance

15th May 2024

Money Masters

11th December 2025

Money languages

11th December 2025

Money languages

11th December 2025