Last Digit Widget

Stimulus. Routine. Reward.

By Vicky Reynal

Good with money

I’ve got to admit: I went a bit off-piste last Saturday. Instead of browsing the January sales or finding another cosy café for hot chocolate, I created a 2025 budgeting workshop for two of my friends.

I’m not an advisor or anything. I just feel calmer when I have a plan for my money, and thought my friends might find the same. They’re both building up flat deposits, but with a year of 30ths ahead, they’re worried about how they’ll manage to keep saving, while also setting aside enough for birthday trips and celebrations (plus a potential barrage of hen dos and summer weddings).

So, I invited them over, brewed us all large mugs of tea and walked them through how I budget with Starling. And how I organise my savings.

In advance of our budgeting workshop, I asked my friends (let’s call them M and S – appropriate) to bring their laptops and a notebook. I provided the pens and the tub of rocky road mini bites.

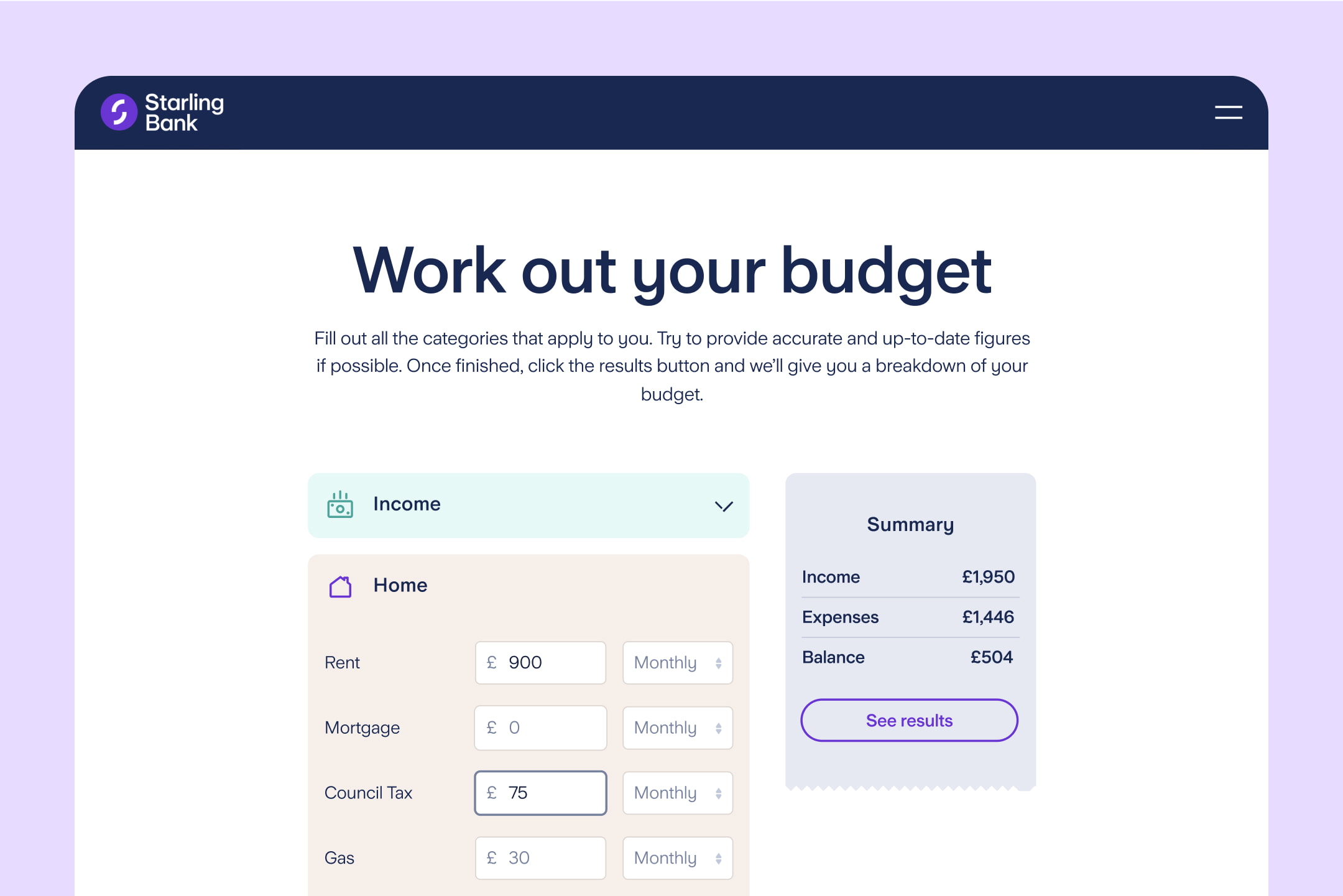

The first step was to pull up Starling’s Budget Planner – a free online tool that can be used by anyone, not just Starling customers – and open our banking apps so that we could check our exact monthly income after tax.

When we scrolled down to the ‘Home’ category in the Budget Planner, I suggested we go through the Budget Planner twice – once for the costs of the things we need, and again for the costs of things we want.

For me, the easiest way to think about a budget is in thirds: needs, wants and savings. This is how the 50:30:20 rule works, with 50% of your income going on essentials, 30% allocated for things you want and 20% set aside as savings.

Of course, you can always adjust these percentages (a lot of people need more than 50% of their income for essentials) and break down spending categories further, often known as zero-based budgeting.

M and S both liked the idea of getting a clear picture of what their essentials cost first. So we only filled in categories such as ‘Council tax’ ‘Gas’ and ‘Electricity’, and left ‘TV packages and streaming services’ blank (however much we want it to be, Disney+ is not an essential).

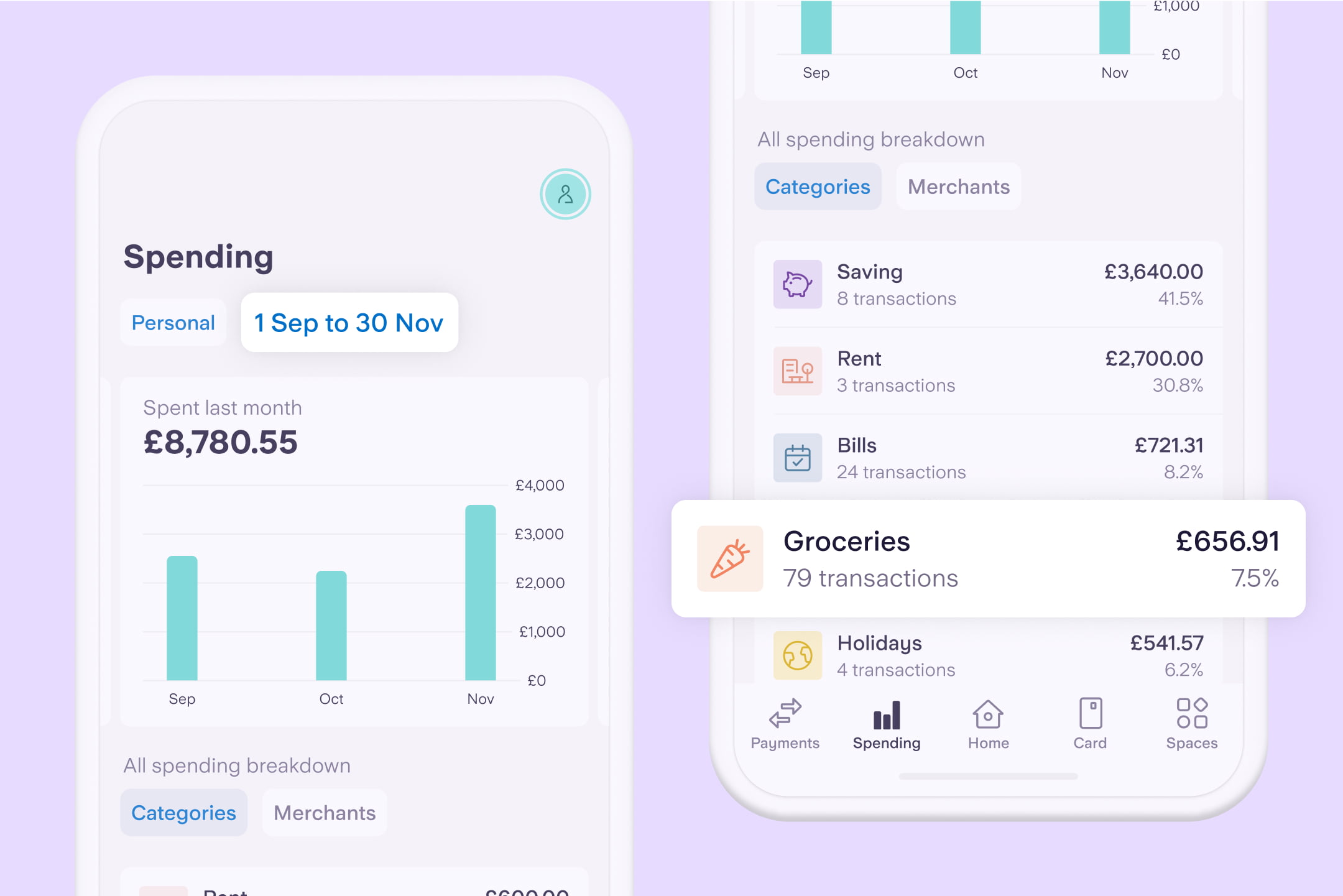

For costs that vary month to month, such as ‘Household groceries’, I suggested finding a monthly average. For S, who banks with Starling, she simply used our AI Spending Insights feature to ask what she’d spent on ‘Groceries’ in the last three months, then divided this total by three to find an average.

As none of us have children yet, we only needed to look at the ‘Insurance’ and ‘Transport’ categories for other essential expenses, before clicking ‘See Results’.

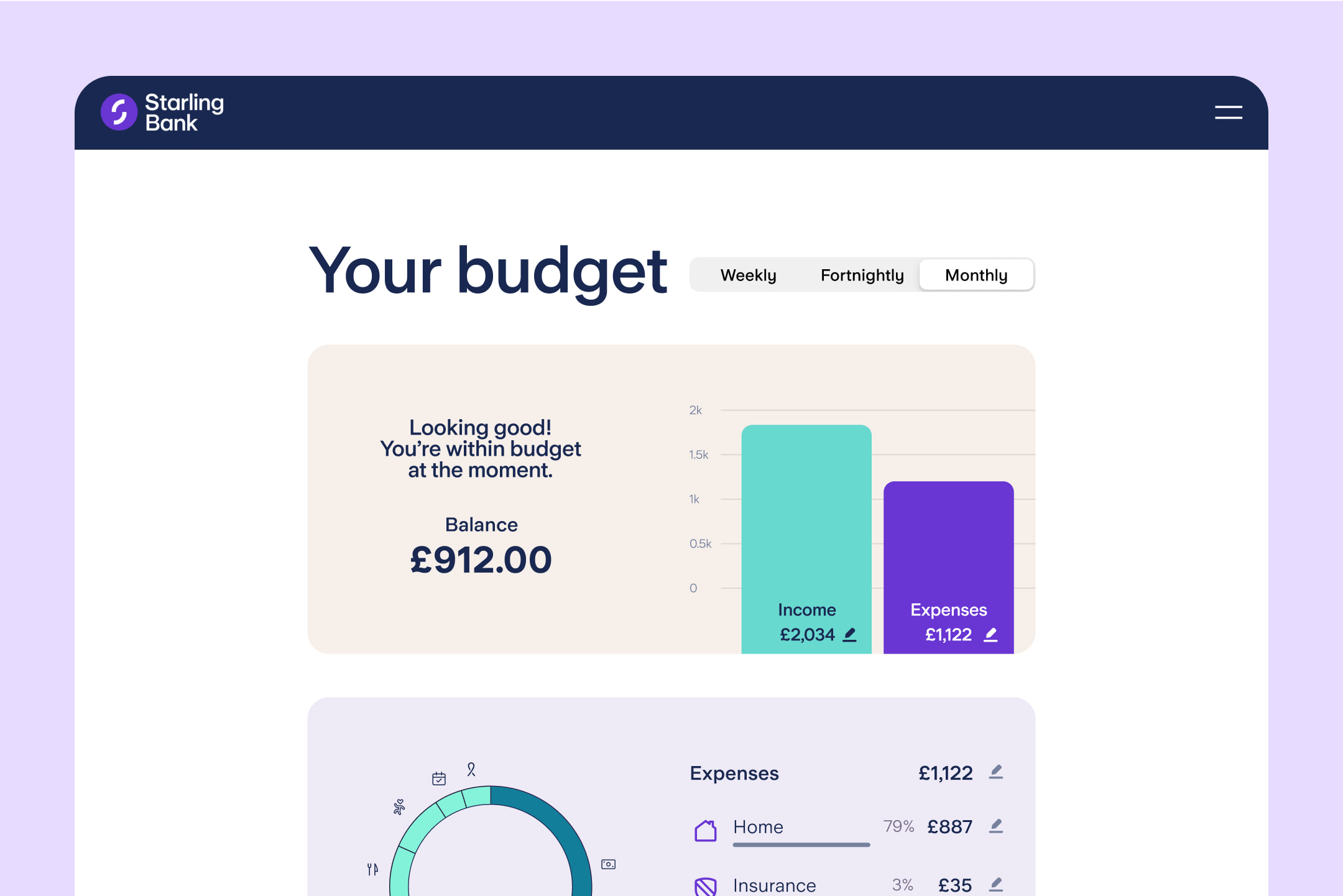

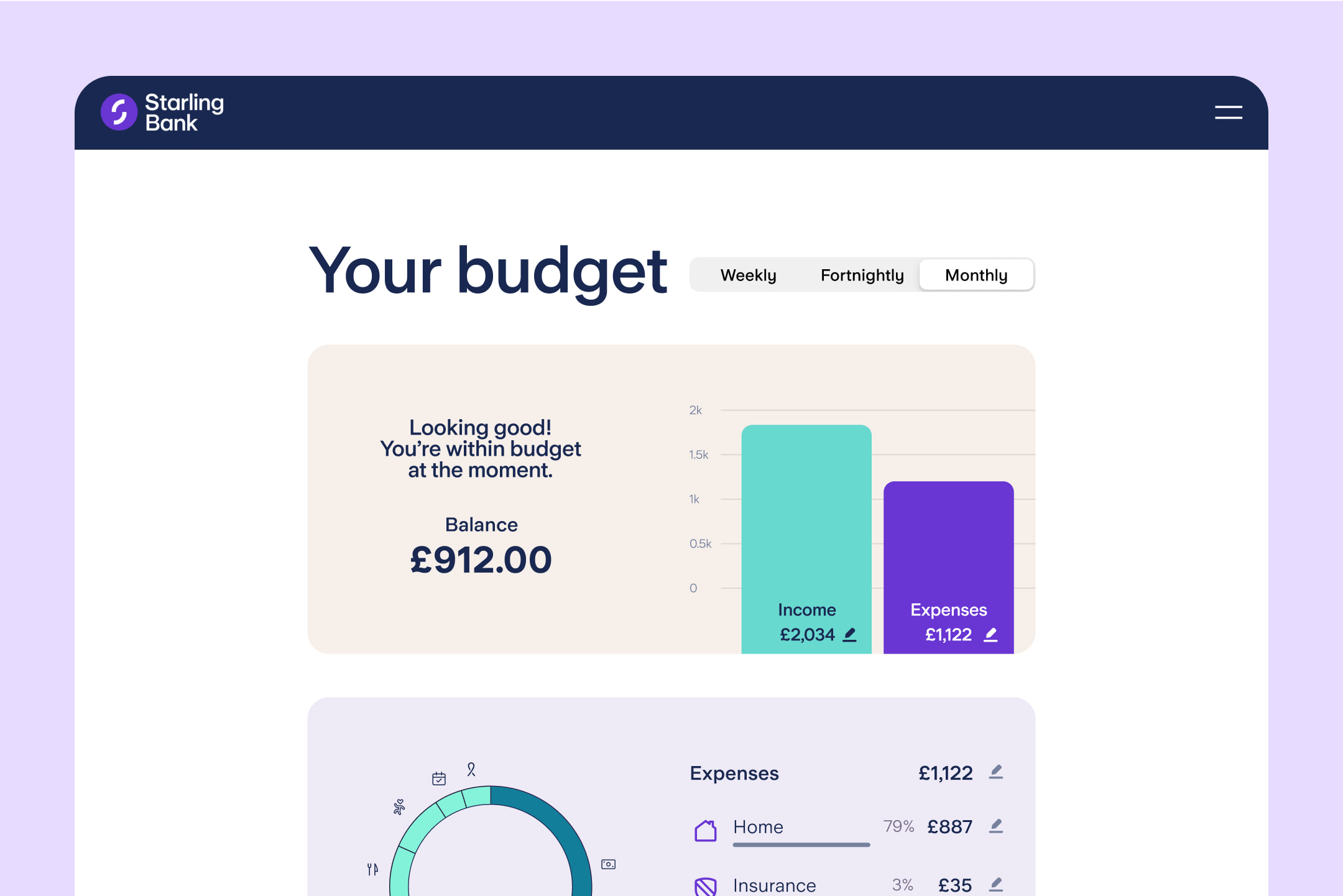

The next screen showed a few automatic calculations: total income, total expenses, and the difference between the two.

In our case, the difference between income and expenses was the amount we had to play with – as savings for the future or spending month to month.

As both M and S want to prioritise saving, we talked about the idea of ‘Paying yourself first’. I know – it’s an odd phrase, but it’s a great concept, which goes like this.

1. Decide on how much you want to save each month.

2. Move this amount into your savings account as soon as you’re paid.

No more making your way through the month and hoping they’ll be something leftover at the end.

After noting down what they wanted to save every month, we clicked ‘Edit’ and scrolled through the categories again, this time with two differences.

First: Including a ‘Pay yourself first’ saving for flat deposits (added as ‘Other’ in the ‘Home’ category). Second: No more skipping over non-essential categories.

As we entered various costs, the figures on the left automatically adjusted to show how much each of us had left – guiding all of us to lower our monthly budgets for ‘Eating out and takeaways’ so that more could be allocated towards ‘Birthdays’ and ‘Holidays’.

When we clicked ‘See Results’ again, we each had a complete budget that we could save for free.

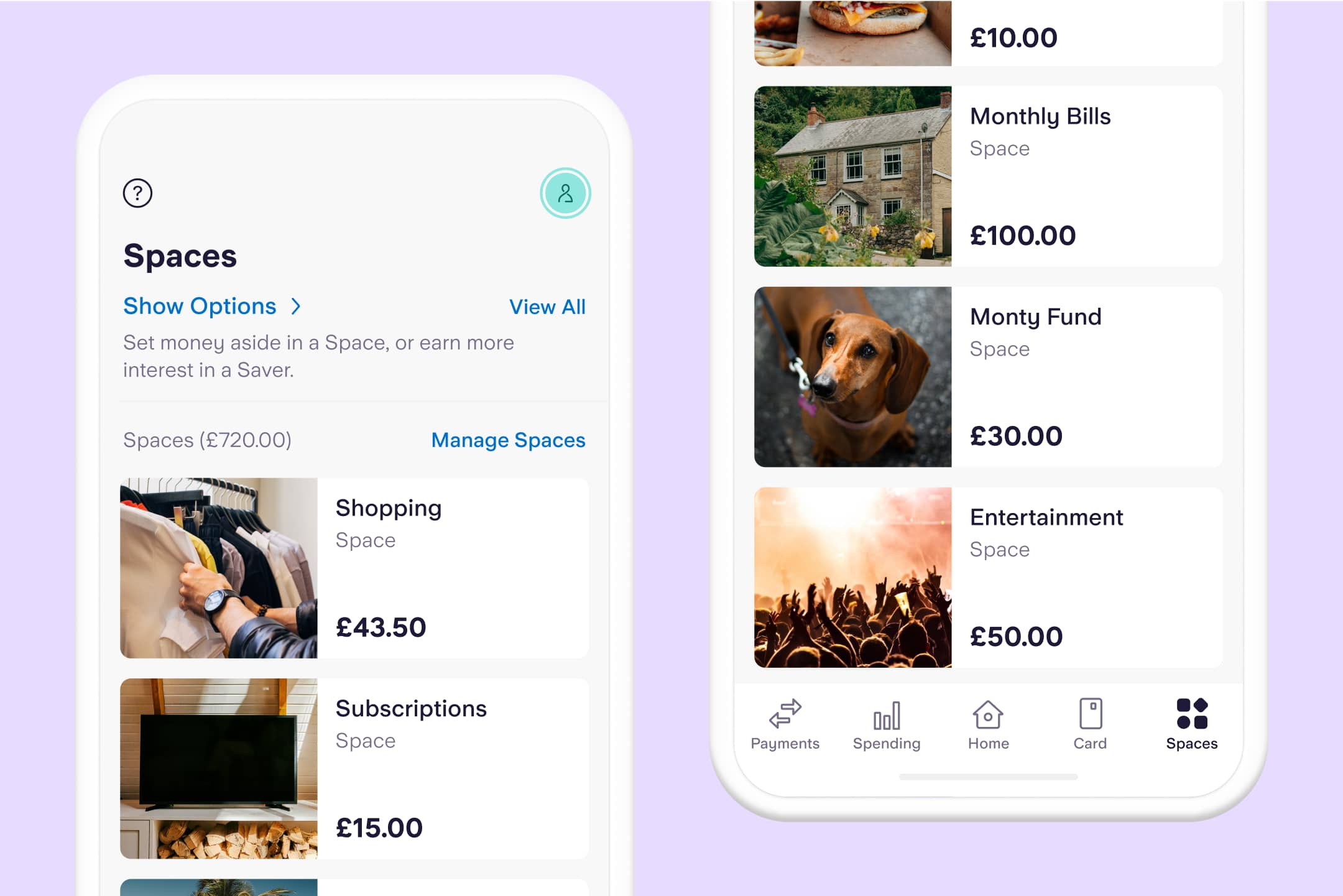

Just when they thought we’d finished, I revealed my actual budgeting secret: Spaces. I have 17 in total, split across my personal Starling account and my joint Starling account.

Each month, the amount I’ve allocated in my budget for ‘Shopping’ ‘Entertainment’ etc. is automatically transferred into various Spaces. These become my digital envelopes – organised and easy to check if I’m wondering how much I have left to spend on ‘Eating out’ that month.

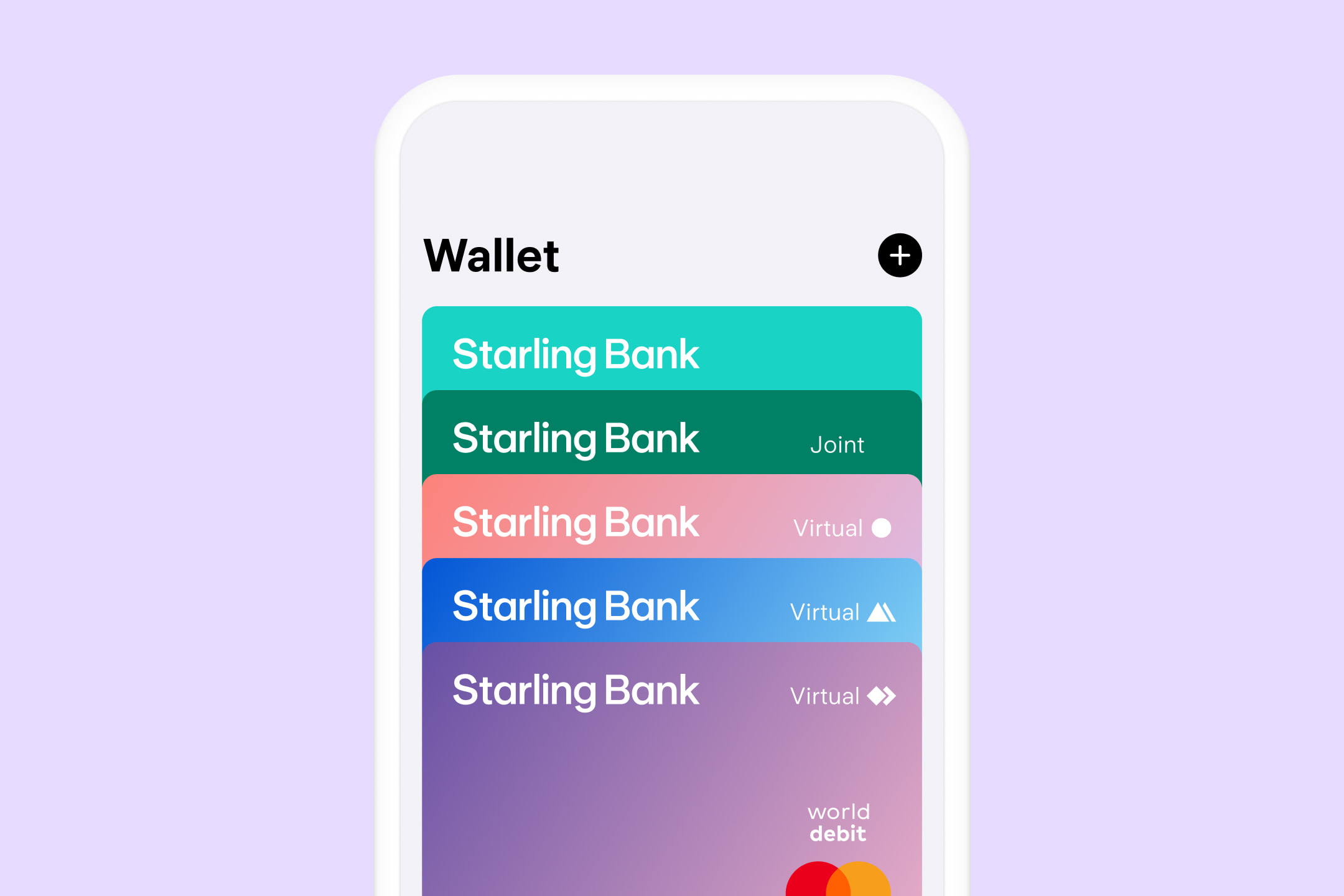

To spend from each ‘envelope’, I use Bills Manager or a virtual card, or simply transfer money out of a Space and into my main balance.

For example, my partner and I use Bills Manager to pay the Direct Debits for our council tax, electricity and WiFi from the ‘Bills’ Space in our joint account. And virtual cards to spend from our ‘Groceries’ and ‘Subscriptions’ Spaces, using Apple Pay or Google Pay. You can have up to five virtual cards for a joint account and another five for a personal account.

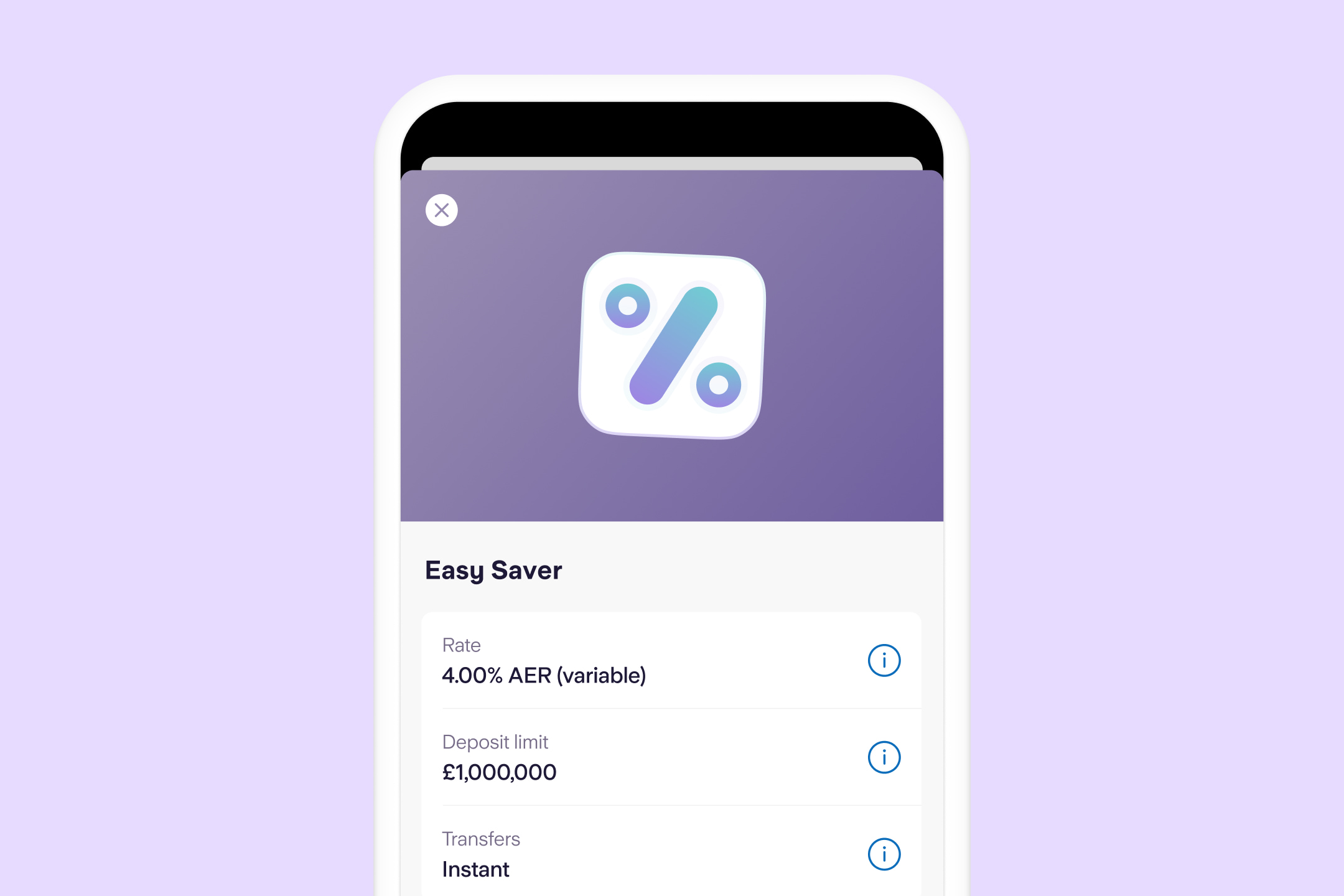

The last few rocky roads were eaten while we talked about savings. Most of mine are in an Easy Saver and act as an emergency fund. The Easy Saver is Starling’s savings account, which has an interest rate of 2.50% AER (2.46% gross variable interest).*

I love that it keeps my savings visible and accessible. And organised in the same app where I can see all my spending.

There’s almost always a gap between what you plan (or budget) for and what you actually manage to do. But with Starling, and tools like Spending Insights and Spaces, that gap is so much easier to see – which is exactly what helps me to narrow it (no more rocky roads for me…).

* Rate accurate as of 22nd December 2025. Terms and conditions apply. Personal current account required. Interest paid monthly. Gross is the contractual rate of interest payable before the deduction of income tax; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Add to your savings and fall back on them when you need to, all while earning interest.

Explore our Easy Saver