Introducing:

The

‘Play’ Gap

Introducing:

The

‘Play’ Gap

Make pocket money equal

When does the gender pay gap start, and why? Working with Professor Tim Jay, an educational psychologist at Loughborough University, we discovered that boys get 20% more pocket money every week, while products marketed at girls cost 5% more.

And it doesn’t stop there. Boys and girls earn – and learn – about pocket money in different ways too, which sets them up with different financial literacy skills.

An unequal start for children leads to an unequal future for us all. Let’s Make Pocket Money Equal.

By playing this video you agree to YouTube's use of cookies. This use may include analytics, personalisation and ads.

The true Play Gap revealed

What contributes to the gender pay gap? Turns out, it all starts in childhood.

Download the report

The ABC of financial literacy

Professor Tim Jay suggests a simple three point step that helps parents get to grips with money talk.

Read the article

Didn’t catch Make Money Equal?

We’ve been campaigning since 2018, raising awareness about how women are portrayed with, and spoken to, about money.

Read our manifesto

Advice hub:

How can you Make Pocket Money Equal?

Tools to try together

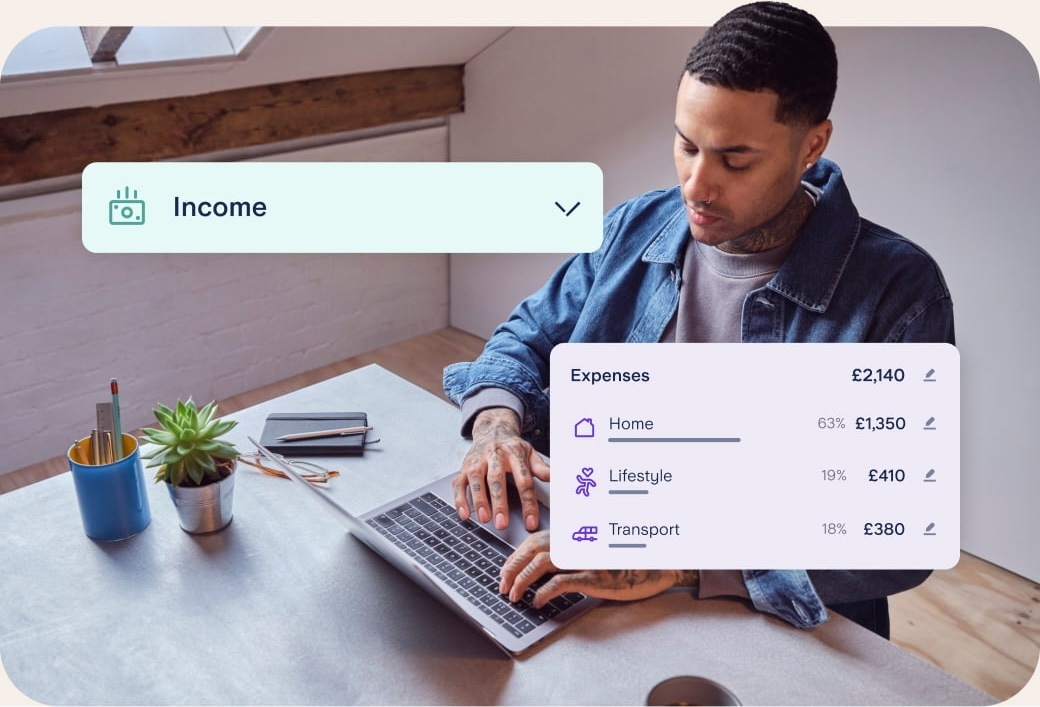

Budget Planner

We’ve launched a free, easy-to-use Budget Planner that helps you take control of your money. It only takes 5-10 minutes – remember to factor in pocket money!

Go to Budget Planner

Starling Kite takeover challenge

What happens if you give kids control of the family budget? We asked three podcasters to find out. Dare to try it? Start with our worksheet.

Download the worksheet

Pocket Money Budget Sheet

A practical way to get kids thinking ahead to goals – as well as factoring in weekly treats. Stick on the fridge and keep track together!

Download the worksheet

Starling Kite: award-winning debit card and app for kids

Help kids manage their pocket money and turn their spending into skills. You stay in control in your app while they learn about money.

Learn more about Kite